IF THE RBI’S RECENT CREDIT policy is anything to go by, talk of whether the central bank is really an independent institution is proving just that, mere talk, considering that the RBI walked the path on its mandate of inflation-targeting keeping aside economic-growth considerations for the moment.

Against the wide expectations of bankers, economists and industry stalwarts, the Monetary Policy Committee (MPC), headed by RBI Governor Urjit Patel, did not let its guard down against inflation. The RBI in its announcement on 8 February kept the repo rate or the lending rate status quo at 6.25 percent.

After the demand-squeezing effect of demonetisation, a rate cut was seen as a kick-starter to the economy. A 25 basis point rate cut would have spurred more dips in rates, which could have brought back demand for automobiles and housing.

Well, RBI is doing no such thing and, to top it, the central bank has altered its policy commentary from ‘accommodative’ to ‘neutral’, which came as a shocker to the financial markets. The impact on bond markets was knee-jerk. The 10-year government securities (G-sec), which dipped to 6.4 percent post-demonetisation, climbed to 6.7 percent, back to its pre-demonetisation levels (See chart: Back To Square One).

The RBI has had an ‘accommodative’ stance on interest rates for some time now implying a general downward bias in interest rates. The rates have been on a downward trajectory for the past two years, since January 2015, with cumulative cuts of 175 basis points till date.

“Markets were expecting a rate cut, but the full impact of the demonestation is still unclear,” say Kuntul Sur, Partner, Risk and Regulatory, PwC India. “This is an apolitical move and I don’t see any influence whatsoever.”

هذه القصة مأخوذة من طبعة February 06, 2017 من Businessworld.

ابدأ النسخة التجريبية المجانية من Magzter GOLD لمدة 7 أيام للوصول إلى آلاف القصص المتميزة المنسقة وأكثر من 9,000 مجلة وصحيفة.

بالفعل مشترك ? تسجيل الدخول

هذه القصة مأخوذة من طبعة February 06, 2017 من Businessworld.

ابدأ النسخة التجريبية المجانية من Magzter GOLD لمدة 7 أيام للوصول إلى آلاف القصص المتميزة المنسقة وأكثر من 9,000 مجلة وصحيفة.

بالفعل مشترك? تسجيل الدخول

Technology, AI Driving Warehousing Sustainability

Anshul Singhal on how Welspun One is rapidly transforming Grade-A logistics and industrial parks across India, offering integrated fund development and asset management for large-scale warehousing solutions

DECODING RETAIL'S NEXT FRONTIER

As brands pivot towards omnichannel ecosystems and startups challenge legacy frameworks, the focus sharpens on experiential retail, sustainability and data-driven personalisation.

SORORITY OF WOMEN OF METTLE

Awinter afternoon in mid-December found quite a crowd at the Oxford Book Store on Connaught Place, as bibliophiles congregated at a corner to listen to three women authors, diverse in their passions, but drawn together by an urge to tell their story.

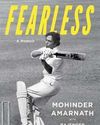

THE LEGACY OF THE AMARNATHS

IN NOVEMBER 2017 the management committee of the Delhi Cricket Association named the eastern stand of the Feroze Shah Kotla ground the Mohinder Amarnath stand.

PUTTING THE POWER IN THE POWERHOUSE

The Asus ExpertBook P5 is powered by an 8-core 8-thread Intel Core Ultra 7 Series 2 processor that clocks a maximum speed of 4.8 GHz, but it does not have hyperthreading. It is light weight, with a smooth glass touch pad. The laptop almost has all the I/O ports you could possibly need in a business laptop, making it an extremely lucrative option for professional computing, says

"We must be aware of our energy and water consumption"

BW Businessworld caught up with actor, philanthropist, and climate warrior BHUMI PEDNEKAR to chat about climate change and more.

"Cooking is a passport to the world"

In conversation with renowned CHEF MANJIT GILL, Advisor at Kikkoman India and President, Indian Federation of Culinary Associations (IFCA). As the former Corporate Chef of ITC hotels, Chef Gill has helped shape iconic restaurants, such as the Bukhara, Dum Pukht, and Dakshin. He has had the privilege of serving former American Presidents Barack Obama, Bill Clinton, George Bush, and the French, Canadian, British and German premiers. In 1992, Chef Gill had the opportunity of being invited to cook for Prince Charles and Lady Diana, at the Palace of the Maharaja of Jaipur. He was awarded the Lifetime Achievement Award from the Ministry of Tourism in 2007.

Strengthening Middle Management for Organisational Resilience

WHAT HOLDS AN organisation together in chaos? Is it visionary leadership, cuttingedge strategies, or robust technology?

The Retail Trailblazers

A look at companies that are making a positive impact on India's growing retail sector with their future fit business and marketing strategies.

Driving Conscious Consumerism

VIDIT JAIN, Co-founder of Kindlife, is leading the charge in revolutionising the intersection of technology and conscious consumerism.