CATEGORIES

فئات

Machines Like Us

A new musical on Broadway—imported from Seoul—asks age-old questions about romance, mortality, and living life to the fullest. The twist? Robots.

Can the Cult of Kiko Kostadinov Go Mainstream?

Rather than dilute his vision for the masses, fashion's wildest young designer is converting fans to the church of the weird.

Zenith Shoots for the Rainbow

Long lauded by in-the-know collectors for its technical achievements, the storied Swiss maker is aiming to go pop with an audacious new timepiece.

Another World

A decade ago the artist Lorna Simpson took up painting for the first time. A monumental new show at The Metropolitan Museum of Art reveals all she's accomplished.

BURNING BRIGHT

Tyla's rise, from South African newcomer to a global popiano sensation, is a reminder that dance music knows no boundaries.

The Future of Sperm

ONE CHILDLESS MAN'S JOURNEY THROUGH THE SCI-FI START-UPS, DIY DONOR CLUBS, AND GROUP MASTURBATION RETREATS ATTEMPTING TO SAVE THE WORLD FROM THE MISUNDERSTOOD APOCALYPSE INSIDE MEN'S BODIES.

MARCH MADNESS WITH PAIGE BUCKETS

With elite skills, killer deals, and an army of fans, UConn star Paige Bueckers and the unprecedented powerembodies the excitementof new-school women's basketball.

From the Ground Up

Sarah Burton's post-McQueen life has taken her to Paris and Givenchy, where she's rebuilding the house to imagine a whole new glorious future.

Play time

How does Sabrina Carpenter manage to be modern and nostalgic, girly and glam, sweetly romantic and totally risqué all at the same time? Abby Aguirre meets an irresistible pop conundrum.

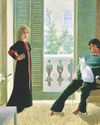

AN EYE ON YVES

Hamish Bowles spent decades collecting the groundbreaking work of Yves Saint Laurent. Now, he writes, it's going on exhibit in the late designer's Marrakech museum.

TRUE ROMANCE

Two lush new books look at the endless allure of the garden.

A Singular Man

Haider Ackermann took a call from Tom Ford, and everything changed: Now he's taking the helm of the brand Ford founded.

TWO PRINCES

At a proving moment in men's tennis, a pair of young challengers on either side of the Atlantic are stepping up.

The Karate Kid Takes a Gap Year

It's the end of an era for Cobra Kai star Xolo Maridueña. On the eve of the series finale, he tells GQ what's next: a soul- searching stint in New York City.

The End of the Affair

Chimamanda Ngozi Adichie's new novel, Dream Count, is haunted by the idea of what could have been. Here, she tells the story of her own first love.

ANATOMY OF A RIOT

Last summer, the murders of three children in a small seaside town in England's northwest triggered a contagion of violence that spread throughout the country practically overnight. The speed and ease with which the riots took shape-propagated by angry men, distorted by social media falsehoods, and amplified by anti-immigrant opportunists-helps explain why this moment when the truth is so fraught is making life in the UK, the US, and beyond feel so dangerous.

What's So Mysterious About John Malkovich?

From directing a play in Latvian to designing eccentric fashion lines to shooting a film that won't be seen until 2115, John Malkovich is one of our most dependably freaky movie stars. In his latest, A24's Opus, he plays a reclusive genius pop star. To learn about the peculiar new role, GQ traveled all the way to... the suburbs of Boston.

HEAT WAVE

A seductive, feverishly celebrated revival of A Streetcar Named Desire arrives in Brooklyn with a blockbuster cast—including an antihero for the ages.

ONCE UPON A TIME IN THE WEST

With new hotels and resorts, Big Sky, Montana, opens up.

ALL IN THE FAMILY

New fiction looks at the ties that bind.

MOP TOPS

With its profusion of feathery layers, the shag is a distinct look, both retro and newly reinvented.

HAVING THEIR SAY

A trio of independent designers— each of whom has launched their brand since the pandemic—talk with Nicole Phelps about their processes, their challenges, and their triumphs.

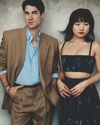

MICHAEL B. JORDAN WANTS TO SLOW DOWN (BUT NOT RIGHT NOW)

The Sinner star once told GQ he intended to spend his 20s doing pedal-to-the-floor work, then reevaluate. But at 38, he's still seeking out new challenges-and pushing that deadline further into the future. FRAZIER THARPE rides shotgun in Jordan's Ferrari to find out what keeps him moving so fast.

OUT OF THE JUNGLE

A retrospective of Brazilian artist Beatriz Milhazes opens at New York's Guggenheim.

Twisted Up

From the outside, Amy Griffin's life appeared picture-perfect. But she knew, deep down, that all was not right. In this excerpt from her memoir, The Tell, the initial signs of a childhood trauma begin to appear.

Energy-Services Companies Sign $4.86 Billion Merger

Italy's Saipem's deal with Subsea7 of Norway seeks to create global giant

Disney-Hulu-Max Bundle Wins at Keeping Its Users

Streamers rolled out a bevy of bundled services last year, hoping they would find ways to keep customers longer. So far, that strategy is working.

Cartel Turf War Jeopardizes Fight Against Fentanyl

Even Jesús Malverde, the patron saint of drug traffickers, has fallen victim to the vicious turf war ripping apart Mexico's biggest producer and smuggler of fentanyl.

Schools Turn to a New Chatbot To Help Support Students

The idea is to meet teens where they are—on their phones—and catch problems early

Bring Warriors Back to the U.S. Military

Recruitment campaigns should frame service as the ultimate test of strength, courage, and leadership.