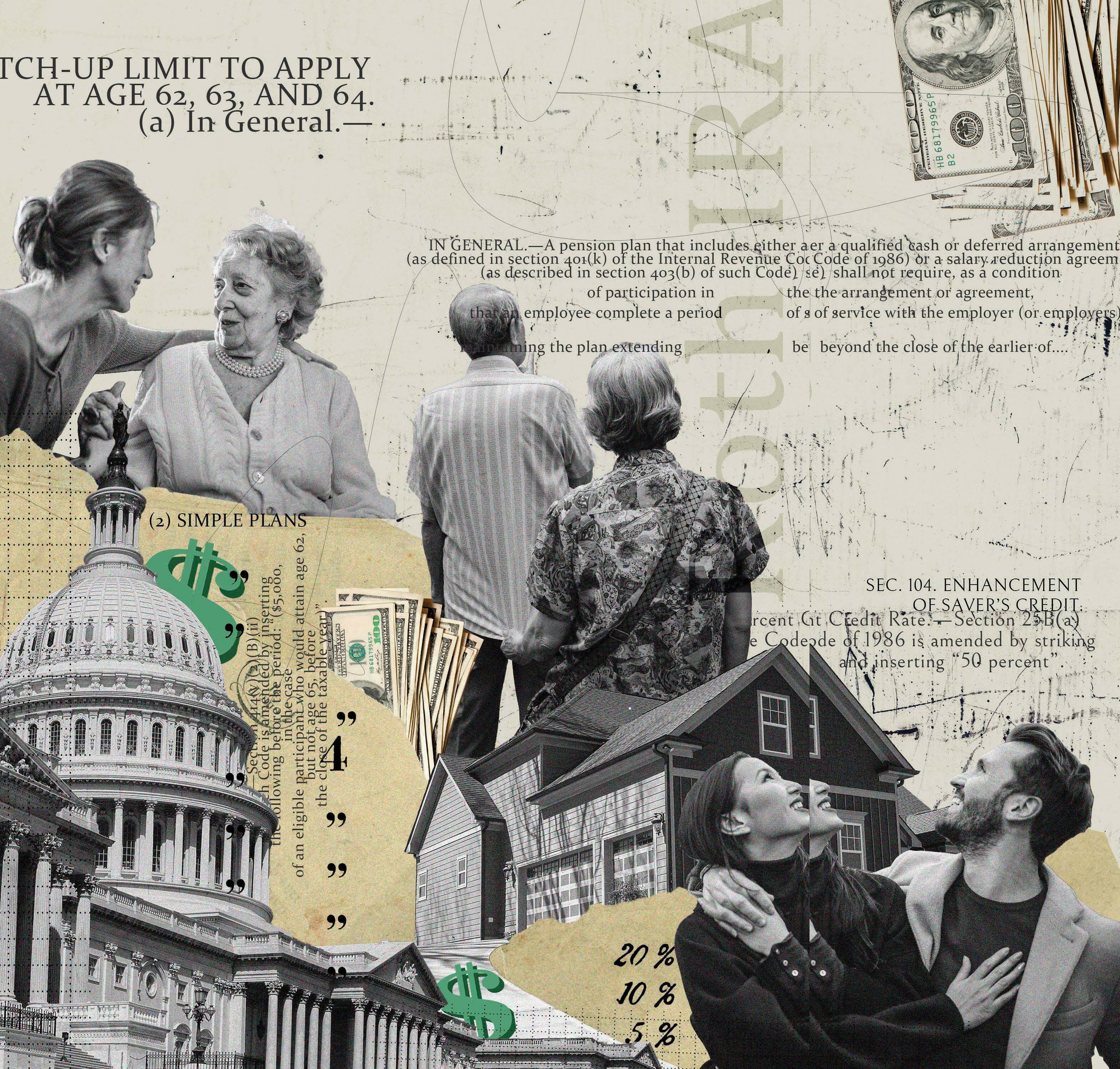

Congress has given retirement savers and retirees a huge gift: a slew of changes designed to help you achieve a more comfortable, financially secure retirement. SECURE Act 2.0, which was signed into law late last year, will affect every stage of retirement planning, from how much you can save in tax-advantaged accounts to how you'll manage your nest egg after you've stopped working. Some of the provisions in this legislative juggernaut won't take effect for a few years, and others will affect only a small percentage of savers. Still, "there's something for everybody" in the legislation, says Catherine Collinson, chief executive officer and president of the Transamerica Institute and Transamerica Center for Retirement Studies. Here's a look at how SECURE Act 2.0 could affect you.

MORE FLEXIBILITY FOR RETIREES AND NEAR-RETIREES

In 2023, the starting age for taking required minimum distributions from traditional IRAS, 401(k)s and other tax-deferred plans increases to 73, up from 72. In 2033, the starting age for RMDS will increase to 75.

The change means that individuals who turn 72 this year will get a one-year delay in RMDs. (Technically, you can wait until April 1, 2025, to take your first RMD, but that means you'll need to take two RMDs in 2025.) The change will be particularly useful to seniors who are still working in their early seventies because they'll be able to delay distributions until they retire and fall into a lower tax bracket. Almost 40% of workers expect to retire at age 70 or older or do not plan to retire, according to the Transamerica Center for Retirement Studies.

هذه القصة مأخوذة من طبعة April 2023 من Kiplinger's Personal Finance.

ابدأ النسخة التجريبية المجانية من Magzter GOLD لمدة 7 أيام للوصول إلى آلاف القصص المتميزة المنسقة وأكثر من 9,000 مجلة وصحيفة.

بالفعل مشترك ? تسجيل الدخول

هذه القصة مأخوذة من طبعة April 2023 من Kiplinger's Personal Finance.

ابدأ النسخة التجريبية المجانية من Magzter GOLD لمدة 7 أيام للوصول إلى آلاف القصص المتميزة المنسقة وأكثر من 9,000 مجلة وصحيفة.

بالفعل مشترك? تسجيل الدخول

HOW INFLATION ADJUSTMENTS WILL AFFECT YOUR TAXES

We looked at IRS rules for 2025 on everything from tax brackets to how much you can save in retirement accounts.

GUARD AGAINST IDENTITY THEFT IN THE NEW YEAR

Scammers are getting better at impersonating legitimate businesses.

SHOULD YOU BUY PET HEALTH INSURANCE?

You can fend off big veterinary bills with a policy that covers your furry companion.

THE LOWDOWN ON BUYING A VACATION HOME

If you return to a beloved destination again and again, purchasing a home there may be a smart move-but don't overlook the costs and effort that go into it.

HOW COUPLES CAN MANAGE DIFFERING RETIREMENT TIME LINES

Staggered retirement is increasingly common, but it can create financial and emotional challenges.

AVOID THESE CREDIT MISSTEPS

KIPLINGER ADVISOR COLLECTIVE

WHAT YOU NEED TO KNOW ABOUT WORKING FOR YOURSELF

Whether you're looking for a side gig or planning to start your own business, it has never been easier to strike out on your own.

My Top 10 Stock Picks for 2025

SINCE 1993, I have offered an annual list of 10 stocks with the potential to beat the market in the 12 months ahead. My 2024 selections notched the highest return ever: an average of 48.9%. I beat the S&P 500 index by 10.8 percentage points, and every one of my stocks was up-six by more than 30%.

WHAT MAKES AN ETF SUCCESSFUL?

EXCHANGE-traded funds have exploded in popularity, with the industry now reaching the milestone of $10 trillion in assets.

TIPS FROM INSIDERS

When corporate insiders buy or sell, it can offer clues on whether you should do the same.