Decentralising local governance is crucial to empowering municipal bodies with greater administrative autonomy and financial independence.

Strengthening municipal revenue streams is not merely a financial necessity but a fundamental requirement for effective urban governance.

Municipalities can develop more responsive and sustainable urban management strategies by diversifying income sources and enhancing fiscal capabilities.

Effective municipal finance management involves a dual approach that necessitates financial transfers from higher levels of government and the proficient generation, use, and allocation of local revenue streams.

In India, urban local bodies (ULBs) face significant challenges in achieving financial autonomy, primarily due to the limited devolution of authority and resources.

Financial transfers to municipal governments account for only 0.45 per cent of India's gross domestic product (GDP), a stark contrast to countries like Brazil, Indonesia, the Philippines, and Mexico, where the figures range from 1.6 per cent to 5.4 per cent.

In European nations, such transfers can even reach 6 per cent to 10 per cent of GDP, exemplifying the critical role of robust intergovernmental fiscal frameworks in supporting local governance.

These international benchmarks highlight the pressing need to enhance financial transfers to Indian municipalities.

Equally important is the ability of municipal bodies to generate their own revenue, an area where they lag significantly.

In this second aspect, municipal finance in India faces a triad of challenges, including low revenue collection, heavy reliance on transfers from the state and the Centre, and an increase in municipal borrowings.

The 2024 RBI report titled "Own Sources of Revenue Generation in Municipal Corporations: Opportunities and Challenges" sheds light on these challenges.

هذه القصة مأخوذة من طبعة December 19, 2024 من Business Standard.

ابدأ النسخة التجريبية المجانية من Magzter GOLD لمدة 7 أيام للوصول إلى آلاف القصص المتميزة المنسقة وأكثر من 9,000 مجلة وصحيفة.

بالفعل مشترك ? تسجيل الدخول

هذه القصة مأخوذة من طبعة December 19, 2024 من Business Standard.

ابدأ النسخة التجريبية المجانية من Magzter GOLD لمدة 7 أيام للوصول إلى آلاف القصص المتميزة المنسقة وأكثر من 9,000 مجلة وصحيفة.

بالفعل مشترك? تسجيل الدخول

CRYING OVER SPILT MILK

From 6.62 in FY18, India’s milk production growth rate has fallen sharply to 3.78% in FY24

The art of leaving

Ravichandran Ashwin, the quintessential cricketing nerd who bamboozled batters through skill, guile, and acumen, stumped fans around the globe on Wednesday when he retired from international cricket with immediate effect at the end of the third Test of the Border-Gavaskar Trophy in Brisbane.

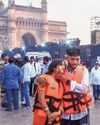

13 dead as Navy speedboat rams into ferry off Mumbai coast

Thirteen persons died and 99 others were rescued after a Navy craft crashed into a ferry off the Mumbai coast on Wednesday, the Navy said.

How senior living market is redefining retirement

With a growing population of India's well-to-do elderly choosing to live well and live free, businesses have spotted an opportunity. The first of a four-part series on the silver economy focuses on luxury housing projects developed with seniors in mind

TRAVEL INSURANCE FOR HOLIDAYERS Sum insured should depend on destination, trip duration, and age

This holiday season, Indian travellers are likely to flock to short-haul destinations.

New coat of opportunity for Berger and Indigo

Analysts see potential in select paint stocks amid entry of big players

Aluminium seen as outlier among metals; Hindalco better placed

Most industrial metals are expected to stay bearish at least in early 2025. However, aluminium could be an exception.

₹ hits fresh low of 84.96 against $

The rupee has depreciated further to close at a fresh low of 84.96 against the US dollar on Wednesday as foreign banks purchased dollars on behalf of their clients ahead of the outcome of the US Federal Reserve meeting, said dealers.

FPI selling ahead of Fed meet drags market down for 3rd day

Overseas investors pull out ₹8,000 crore this week

Bourses see three blockbuster debuts

Mobikwik up 90%; Vishal Mega Mart, Sai Life gain 40%