CATEGORIES

Categories

Latest Stories

Outsmart EMOTIONAL VAMPIRES!

Move over, Dracula: There are very real vampires in our lives who drain our joy and energy. Here, psychologists' simple keys to taking back control, setting clear boundaries and improving all your relationships

CLEAN LIVING WITH DANNY

A question, a recipe and a new product pick from environmental lifestyle pro Danny Seo, a leading expert on modern, eco-friendly food, entertaining and more

SEXY LEO'S SECRET!

He’s played a boytoy in The White Lotus, a charming drunk in the hit One Day and now a hunky young park ranger named, yes, Roxster, in Peacock’s Bridget Jones: Mad About the Boy, the latest movie about the hapless British everywoman played by Renée Zellweger (for more on the actress.

GISELE BABY NO. 3!

She’s a mom again! After surprising her followers with a bump video in October, supermodel Gisele Bündchen has welcomed her first child with boyfriend Joaquim Valente, according to TMZ.

BUTT OUT, MOM!

His Own Man A source tells Star Terri traveled to South Africa with Robert for the I'm a Celebrity... Get Me Out of Here! shoot.

MEGHAN: Let Me Live My Life!

WITH HER EVERY MOVE INCLUDING HER RECENT CHARITY EFFORTS BEING DISSECTED AND CRITICIZED, A SOURCE TELLS STAR A FED-UP MEGHAN MARKLE HAS HAD ENOUGH.

HOW TO Boost Your Health Span

HOW MUCH WEIGHT you can lift isn't just a practical matter: It turns out that being able to carry 75% of your body weight for a minutesometimes referred to as \"the carry test\"-can tell you a lot about your fitness level and health.

SHERYL LEE RALPH My Secret Is 'I Don't Give Up'

Sheryl Lee Ralph is the first to admit that her journey to the top has been a marathon, not a sprint. But it has taught her some valuable lessons along the way.

WINTER WOW: Hair Hues That Flatter

3 stunning shades for different skin tones

Cary Grant THE MAKING of AN ICON

THE LEGENDARY ACTOR’S ROOMMATE HELPED HIM CREATE HIS SMOOTH, CULTURED IMAGE

KAIA GERBER & LEWIS PULLMAN 'Beyond Smitten'

The model is moving on following her split from Austin Butler

SWEET TREATS

Deliciously easy indulgences guaranteed to please

Simple & Special MEALS FOR ONE

Fresh, filling and packed with flavor, these one pot dinners let you cook for yourself with minimal cleanup

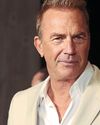

Kevin Costner's STILL GOT IT!

Sexy at 70! The rugged star who's aging like fine wine - has become Hollywood's most eligible bachelor. Us reveals his feelings about finding love after divorce and how he stays at the top of his game

DORIT'S DIVORCE SHOCKER

She's tired of making excuses for her ex. On a recent episode of The Real Housewives of Beverly Hills, Dorit Kemsley admitted she used to cover up for her estranged husband, PK Kemsley.

Follow YOUR DREAMS

The National Lampoon's Vacation alum shares her thoughts on life, creativity and Patsy Cline

Rebellious Child Stars Have Found Their Footing

Lindsay Lohan and Justin Bieber are among the celebs who are so beyond their wild years and we love to see it

RENEE Gets Real

AS HER BELOVED CHARACTER BRIDGET JONES RETURNS, ACTRESS RENÉE ZELLWEGER OPENS UP ABOUT HER BIGGEST REGRETS, WHY SHE LEFT HOLLYWOOD AND A TERRIFYING HEALTH SCARE.

TALKING ABOUT...SELF-ACCEPTANCE, Precious Moments & Silver Linings with actress, podcast host and MS advocate JAMIE-LYNN SIGLER

FOR 15 YEARS, actress Jamie-Lynn Sigler had a secret. Diagnosed with multiple sclerosis at just 20 years old, while starring in HBO's hit series The Sopranos, Jamie-Lynn admits she was in denial.

Jessica & John: UNFINISHED BUSINESS

Newly single Jessica Simpson is mulling a rebound hookup with ex John Mayer.

HODA'S WAKE-UP CALL!

Before she left her job as cohost of the Today show, Hoda Kotb was used to getting up very early.

THE PAW PATROL PRINCIPLE

How a toy company built a children's-television juggernaut

ROGUE ASTEROID HEADED OUR WAY!

Scientists scramble to predict path before it can wipe out cities

This avid reader is on a mission to spread joy!

Emily Bhatnagar loves books, and when her dad was diagnosed with thyroid cancer, they offered a refuge from her fears and worries. It was such a blessing that she’s given away 25,000 books to children’s hospitals!

Easy home fixes for migraine pain

Tired of dealing with migraines? These painful headaches affect about 1 in 5 women in the United States and are three times more common in women than men. Luckily, research proves that there are simple steps you can take to naturally ease head pain whenever and wherever it strikes. Just...

DeepSeek's hidden warning for AI safety

THE RELEASE OF DEEPSEEK R1 STUNNED WALL STREET and Silicon Valley in January, spooking investors and impressing tech leaders.

TIME the Closers

25 BLACK LEADERS WORKING TO END RACIAL INEQUALITY

Justin DRAMA IN THE COURTROOM

After exposing more alleged emails and texts, Justin Baldoni's lawyer faces off with Blake Lively's team in an explosive hearing

MAD ABOUT THE GIRL

AS RENÉE ZELLWEGER REPRISES THE ICONIC CHARACTER, BRIDGET JONES' CREATOR - AND MILLIONS OF FANS, COULDN'T BE HAPPIER

Winning the Global Game

The U.S. holds more cards than China. Whether we keep our strategic advantage depends on how we play our hand