CATEGORIES

Categorieën

Nieuwste verhalen

JEN MOURNS LOST LOVE

Still pining for the one who got away

ANDY SICCED HOUSEWIVES ON LEAH

SMILEY, boyish TV mogul ANDY COHEN is one devious monster, according to former Real Housewives of New York City babe LEAH MCSWEENEY, who claims in a lawsuit the producer-host set an army of his Bravo network hellcats to “attack her” after she claimed he schemed to get her — a reformed boozer — guzzling again to raise ratings.

JIU-JITSU GIRL KICKS BUTT!

Makes mincemeat of adult assailant

KAYAK CATASTROPHE

2 nabbed on charges of jet-ski ramming that killed teen

DEAD PUTIN REPLACED WITH BODY DOUBLES!

Kremlin phonies secretly holding onto power

RENÉE'S ANT IS A LOVE RAT!

Pals don't dig his new digs

NOT ALL ROSY FOR MEAN GIRL O'DONNELL

H'wood wary of suck-up act

TIMOTHEE CANS KARDASHIANS

AS TIMOTHÉE CHALAMET'S romance with Kylie Jenner heats up, the Oscar nominee is desperate to keep away from the rest of the Kardashians.

HUGH & SUTTON'S BABY BOOM

Eyeing adoption to seal the deal

JESSICA OUT OF JUICE

Renner ignores her romantic broadsides

KRIS MAY GET BLACK EYE OVER FANCY NEW FACE

COCKY Kris Jenner is celebrating the success of her new surgical face-job, but hey, no one can beat Father Time — even if she has lucked out for the moment.

REVEALED: UFO BASE INSIDE ALASKA MOUNTAIN

CIA monitors secret hideaway

EX-CIA DISGUISE CHIEF UNMASKS M:I SPYCRAFT

Cruise franchise gets top marks

DREW FLIRTS WITH DANGER

Pals worry his late-night antics court backslide

Billy Joel Says He's 'Not Dying' as New Doc Reveals Shocking Secrets About His First Marriage

When Howard Stern grabbed dinner with longtime friend Billy Joel in late May, the Grammy-winning musician told the radio host that despite his diagnosis with a rare brain condition, all is well. “He’s doing fine. He does have issues, but he said, ‘You can tell people I’m not dying,’” Stern relayed in the June 3 episode of his SiriusXM show.

Plastic Surgery Confessions: Celebs Get Real About Their Work

Kylie Jenner, 27, rocked the Internet on June 2 when she revealed her exact breast implant specs as well as the surgeon behind them (Dr. Garth Fisher).

Halle Berry's Boyfriend Van Hunt Proposes After Five Years of Dating

Halle Berry and musician Van Hunt are in the next phase of their relationship. Following the couple's first joint interview on June 4, the Grammy winner, 55, revealed to \"today.com\" that he had proposed to the Oscar winner.

DUFF GOLDMAN Red, White & Blue Roulade Cake

The colors are perfect for the holiday, and it's a gorgeous presentation when sliced,' says the pastry chef and star of the new Food Network competition series Super Mega Cakes.

Our Must-Reads for Summer!

NO MATTER WHERE YOU'RE HEADED THIS SEASON, THESE BOOKS WILL MAKE YOU FEEL LIKE YOU’RE ON VACATION Edited by

Zoe Saldaña Is Enjoying the Moment

THE OSCAR-WINNING ACTRESS STARS IN THE NEW PIXAR MOVIE ELIO—BUT SHE’S BEING A ‘NORMAL’ MOM THIS SUMMER

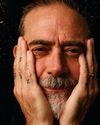

JEFFREY DEAN MORGAN TAKING A BIG SWING

THE WALKING DEAD STAR OPENS UP ABOUT FATHERHOOD AND HITTING THE ROAD IN AN UNEXPECTED NEW ROLE

Hollywood TURNS BACK THE CLOCK

Have these A-listers found the fountain of youth in skincare products — or just a really good plastic surgeon?

Jen Helps Plan Selena's Wedding!

\"Jennifer always gives me advice,\" Selena told Elle in November.

Coral Reefs In Peril

How we can protect the ocean right now

Q&A With Sylvia Earle

The ocean conservationist on hope, and why she keeps diving

Valuing Our Oceans

It's time for a shift in economics

A New Turbulence

Politics is roiling the waters that should connect us

Phil Robertson

Duck Dynasty star Phil Robertson died at age 79, his family announced on May 25, a few months after revealing he had been diagnosed with Alzheimer's disease.

Boulder, Colo., attack highlights rising antisemitism

THE FIREBOMBING OF A RALLY IN Boulder, Colo., supporting the release of Israeli hostages held in Gaza continued a surge in antisemitic incidents and hate crimes toward Jewish Americans.

Step Into Style

PUT YOUR BEST FOOT FORWARD THIS SUMMER IN THESE CELEB-LOVED SHOE TRENDS