Trump may well soften his opposition to low interest rates once he’s in the Oval Office

The Supreme Court isn’t the only institution President-elect Donald Trump could influence over the next four years. He could also reshape the Federal Reserve—the high court of money. There are already two vacancies on the Fed’s Board of Governors for him to fill next year. Two more seats, including that of Chair Janet Yellen, are likely to open up by the time his term is a year and a half old, giving him a majority of appointees on the seven-member board. He could also put his stamp on the central bank by signing legislation to force the Fed to publish a rate-setting rule and follow it.

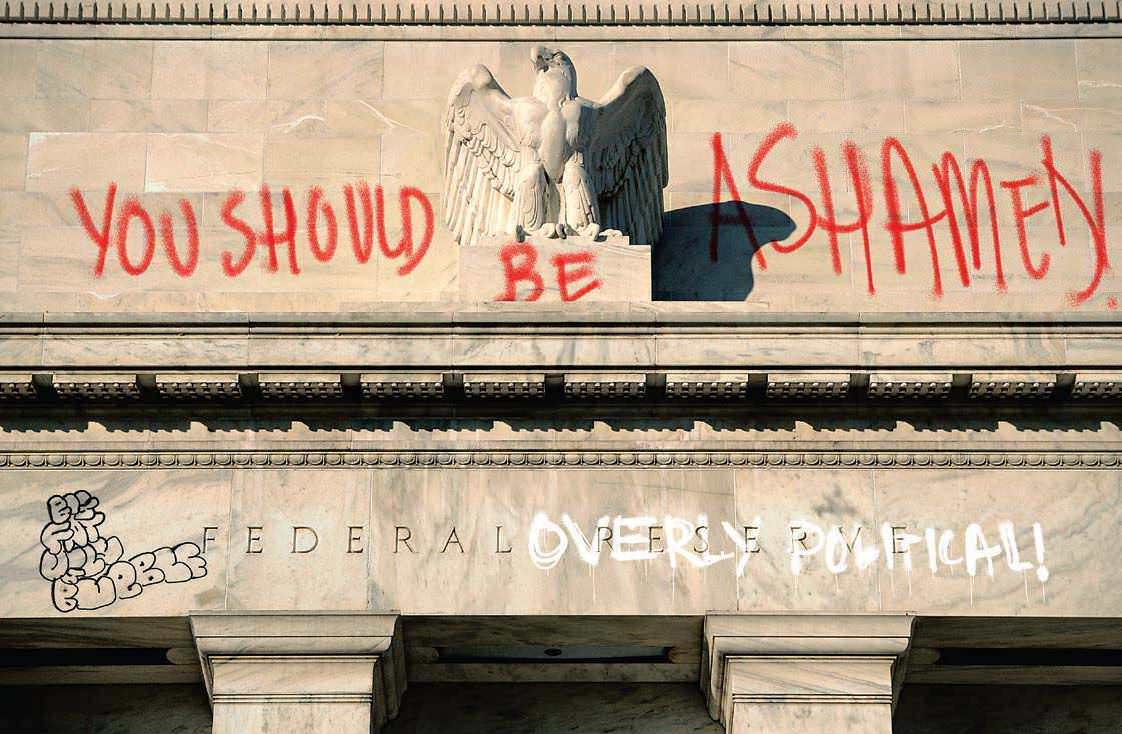

Trump’s power to remake the Fed has to alarm the occupants of its headquarters on Constitution Avenue. As a candidate he delighted in bashing Yellen, saying she was keeping rates low to prop up the Democrats. He called her more political than Hillary Clinton. He said the Fed’s cheap money had inflated “a big, fat, ugly bubble” and, with some justification, that savers were “getting just absolutely creamed” by low rates.

But what Trump will do about the Fed once he gets in office is far from clear. He could certainly name Fed governors who would be more hawkish than Yellen and her board allies—more partial to raising interest rates to stave off inflation and keep asset bubbles from forming. It’s also possible, though, that he could revert to his roots as a real estate developer and favor low interest rates that encourage, or accommodate, faster economic growth. A turn to dovishness wouldn’t be surprising—it’s typical for incumbent presidents to want rates low for as long as they’re in office. There’s even talk that Trump could reappoint Yellen to another four year term when her current one ends on Feb. 3, 2018.

Diese Geschichte stammt aus der December 5 - December 11, 2016-Ausgabe von Bloomberg Businessweek.

Starten Sie Ihre 7-tägige kostenlose Testversion von Magzter GOLD, um auf Tausende kuratierte Premium-Storys sowie über 8.000 Zeitschriften und Zeitungen zuzugreifen.

Bereits Abonnent ? Anmelden

Diese Geschichte stammt aus der December 5 - December 11, 2016-Ausgabe von Bloomberg Businessweek.

Starten Sie Ihre 7-tägige kostenlose Testversion von Magzter GOLD, um auf Tausende kuratierte Premium-Storys sowie über 8.000 Zeitschriften und Zeitungen zuzugreifen.

Bereits Abonnent? Anmelden

Instagram's Founders Say It's Time for a New Social App

The rise of AI and the fall of Twitter could create opportunities for upstarts

Running in Circles

A subscription running shoe program aims to fight footwear waste

What I Learned Working at a Hawaiien Mega-Resort

Nine wild secrets from the staff at Turtle Bay, who have to manage everyone from haughty honeymooners to go-go-dancing golfers.

How Noma Will Blossom In Kyoto

The best restaurant in the world just began its second pop-up in Japan. Here's what's cooking

The Last-Mover Problem

A startup called Sennder is trying to bring an extremely tech-resistant industry into the age of apps

Tick Tock, TikTok

The US thinks the Chinese-owned social media app is a major national security risk. TikTok is running out of ways to avoid a ban

Cleaner Clothing Dye, Made From Bacteria

A UK company produces colors with less water than conventional methods and no toxic chemicals

Pumping Heat in Hamburg

The German port city plans to store hot water underground and bring it up to heat homes in the winter

Sustainability: Calamari's Climate Edge

Squid's ability to flourish in warmer waters makes it fitting for a diet for the changing environment

New Money, New Problems

In Naples, an influx of wealthy is displacing out-of-towners lower-income workers