The consumption story that has been the key driver for many sectors may now be driving the stock market itself.

JUDGING THE WAY the stock markets have been swinging ever since the start of 2017, the party seems to have only just begun. The occasional pull-back in stock prices is being increasingly seen as the green light by investors to dive into favoured stocks again. These small corrections are short-lived, and stocks are quickly back to doing what they like to do at present — and that is to go dance up.

The result? The bellwether index crossed a new high in March and, with the Nifty at around 9200, chances are that markets could hit the coveted 10000 gong before 2018. Perhaps, much earlier.

By all accounts, this is a crazy bull market, fuelled by the vast domestic inflows to the market. If the demonetisation has done something right, it seems to have channelled more money in the direction of stocks.

Domestic institutional investors (DIIs) are increasingly pouring money into the stock market. Regular investments in the form of SIP are the new rage. At current value, more than Rs 4,000 crore of hard cash is making its way into the stock market every month through SIPs.

To give a perspective, this used to be the kind of sums foreign institutional investors (FIIs) put in Indian markets a few years ago. In 2008, FIIs sold stocks worth Rs 60 crore-70 crore; now DIIs alone are pouring in sums nearly equal that in a year.

By 2018 or so, the amount of money coming through the SIP route is expected to comfortably rise by 50 per cent. This means a cool Rs 6,000 crore-plus is expected to flow into the markets via SIPs. If this continues, widening whispers in market circles say: Who needs FIIs anymore?

Diese Geschichte stammt aus der April 15, 2017-Ausgabe von Businessworld.

Starten Sie Ihre 7-tägige kostenlose Testversion von Magzter GOLD, um auf Tausende kuratierte Premium-Storys sowie über 8.000 Zeitschriften und Zeitungen zuzugreifen.

Bereits Abonnent ? Anmelden

Diese Geschichte stammt aus der April 15, 2017-Ausgabe von Businessworld.

Starten Sie Ihre 7-tägige kostenlose Testversion von Magzter GOLD, um auf Tausende kuratierte Premium-Storys sowie über 8.000 Zeitschriften und Zeitungen zuzugreifen.

Bereits Abonnent? Anmelden

Technology, AI Driving Warehousing Sustainability

Anshul Singhal on how Welspun One is rapidly transforming Grade-A logistics and industrial parks across India, offering integrated fund development and asset management for large-scale warehousing solutions

DECODING RETAIL'S NEXT FRONTIER

As brands pivot towards omnichannel ecosystems and startups challenge legacy frameworks, the focus sharpens on experiential retail, sustainability and data-driven personalisation.

SORORITY OF WOMEN OF METTLE

Awinter afternoon in mid-December found quite a crowd at the Oxford Book Store on Connaught Place, as bibliophiles congregated at a corner to listen to three women authors, diverse in their passions, but drawn together by an urge to tell their story.

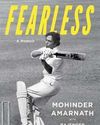

THE LEGACY OF THE AMARNATHS

IN NOVEMBER 2017 the management committee of the Delhi Cricket Association named the eastern stand of the Feroze Shah Kotla ground the Mohinder Amarnath stand.

PUTTING THE POWER IN THE POWERHOUSE

The Asus ExpertBook P5 is powered by an 8-core 8-thread Intel Core Ultra 7 Series 2 processor that clocks a maximum speed of 4.8 GHz, but it does not have hyperthreading. It is light weight, with a smooth glass touch pad. The laptop almost has all the I/O ports you could possibly need in a business laptop, making it an extremely lucrative option for professional computing, says

"We must be aware of our energy and water consumption"

BW Businessworld caught up with actor, philanthropist, and climate warrior BHUMI PEDNEKAR to chat about climate change and more.

"Cooking is a passport to the world"

In conversation with renowned CHEF MANJIT GILL, Advisor at Kikkoman India and President, Indian Federation of Culinary Associations (IFCA). As the former Corporate Chef of ITC hotels, Chef Gill has helped shape iconic restaurants, such as the Bukhara, Dum Pukht, and Dakshin. He has had the privilege of serving former American Presidents Barack Obama, Bill Clinton, George Bush, and the French, Canadian, British and German premiers. In 1992, Chef Gill had the opportunity of being invited to cook for Prince Charles and Lady Diana, at the Palace of the Maharaja of Jaipur. He was awarded the Lifetime Achievement Award from the Ministry of Tourism in 2007.

Strengthening Middle Management for Organisational Resilience

WHAT HOLDS AN organisation together in chaos? Is it visionary leadership, cuttingedge strategies, or robust technology?

The Retail Trailblazers

A look at companies that are making a positive impact on India's growing retail sector with their future fit business and marketing strategies.

Driving Conscious Consumerism

VIDIT JAIN, Co-founder of Kindlife, is leading the charge in revolutionising the intersection of technology and conscious consumerism.