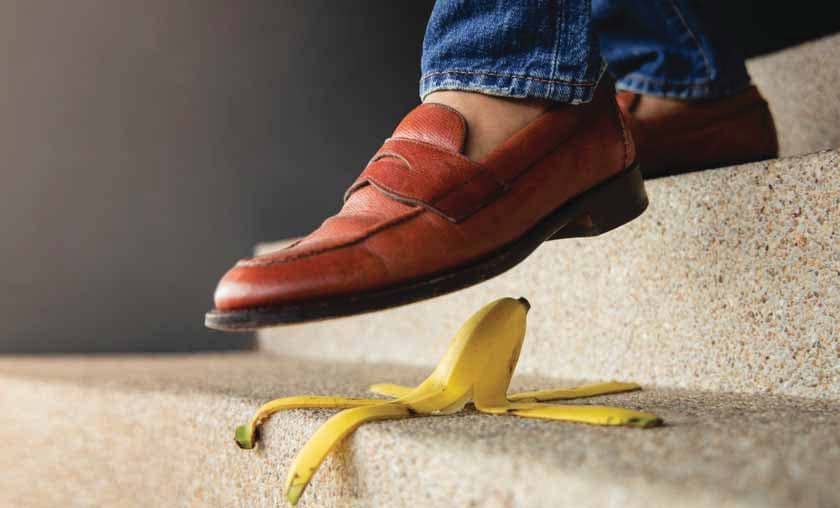

Of all the weird, cultish beliefs that the made-in-Silicon-Valley start-up culture has given rise to, the weirdest is the cult of failure. ‘Fail early and fail fast’ is the mantra that started in the world of venture financing of tech companies but seems to be permeating the wider world of business. This deification of failure, of viewing failure as a rite of passage and as a sort of qualification, is a strange phenomenon.

On the face of it, it seems to reflect the sayings that exist in many cultures that say that people learn from their mistakes better than in any other way. It’s not a new idea. I myself have written more than once in my columns that investors do not really get a feel for investing well unless they have seen a bad situation and made some losses. Only when a market cycle is complete and an equity investor has seen the heady gains of a bull run as well as the sharp setbacks of a decline, can he or she be considered a complete, experienced, and mature investor. So, am I not advocating the same thing as this new ‘learning from failure’ cult?

Diese Geschichte stammt aus der October 2021-Ausgabe von Wealth Insight.

Starten Sie Ihre 7-tägige kostenlose Testversion von Magzter GOLD, um auf Tausende kuratierte Premium-Storys sowie über 8.000 Zeitschriften und Zeitungen zuzugreifen.

Bereits Abonnent ? Anmelden

Diese Geschichte stammt aus der October 2021-Ausgabe von Wealth Insight.

Starten Sie Ihre 7-tägige kostenlose Testversion von Magzter GOLD, um auf Tausende kuratierte Premium-Storys sowie über 8.000 Zeitschriften und Zeitungen zuzugreifen.

Bereits Abonnent? Anmelden

Bad ideas, F&O trading and the market

Find out the mindset required to find success in F&O trading

Licence Raj Redux?

The import policy changes might take us back to the days of License Raj

How to do magic

Getting great equity returns sustainably only looks like magic, it actually isn't

Data protection and cyber security

The increasing need for cyber security is opening up investment opportunities

"Buying is dependent on pricing but not on timing"

Insights of a fund manager at PPFAS Mutual Fund

Pro vs Amateur

Can amateur stock investors be better than pros? Yes! Here's how

The dimming of Brightcom

Shedding light on irregularities at the Brightcom Group

First tryst with profitability

Find out if food aggregators have found a cure to their loss-making curse

Have We Crossed The Peak Of Inflation?

Find out if the present macro scenario calls for tweaking your portfolio strategy

Tomatonomics

The humour, the stories and what could have been done about tomato inflation