THE INSOLVENCY and Bankruptcy Code (IBC) was launched in 2016, with the aim to overhaul the corporate distress resolution regime. It was to protect the interests of small investors and the financial system where public monies are involved.

When a default in repayment occurs, creditors gain control over the debtor's assets and must take decisions to resolve insolvency. The IBC mooted completing the entire insolvency resolution within 180 days, with the possibility of extending the timeline, should creditors consent to it. For smaller companies, including startups with an annual turnover of Rs 1 crore, in case of insolvency, the whole exercise must be completed in 90 days, but the deadline can be extended by another 45 days. If debt resolution doesn't happen, the company goes for liquidation.

Time, Bench Strength & Valuation Concerns

Till September 2022, financial creditors had recovered only about 33 per cent of their claims in 553 corporate insolvency processes that were resolved. It took an average of 560 days to resolve 143 cases in 2021-22, while it had taken 468 days to resolve 120 cases in 2020-21. Moreover, 64 per cent of the ongoing insolvency cases have spilled beyond 270 days. While the RP (insolvency resolution professional) might want to improve on valuations with additional time for resolution, any further delay might lead to erosion in the asset valuations, as well as exodus of human capital in the enterprise. There is also a perception and worry about the lack of transparency in many IBC cases.

Diese Geschichte stammt aus der February 11, 2023-Ausgabe von Businessworld India.

Starten Sie Ihre 7-tägige kostenlose Testversion von Magzter GOLD, um auf Tausende kuratierte Premium-Storys sowie über 8.000 Zeitschriften und Zeitungen zuzugreifen.

Bereits Abonnent ? Anmelden

Diese Geschichte stammt aus der February 11, 2023-Ausgabe von Businessworld India.

Starten Sie Ihre 7-tägige kostenlose Testversion von Magzter GOLD, um auf Tausende kuratierte Premium-Storys sowie über 8.000 Zeitschriften und Zeitungen zuzugreifen.

Bereits Abonnent? Anmelden

Technology, AI Driving Warehousing Sustainability

Anshul Singhal on how Welspun One is rapidly transforming Grade-A logistics and industrial parks across India, offering integrated fund development and asset management for large-scale warehousing solutions

DECODING RETAIL'S NEXT FRONTIER

As brands pivot towards omnichannel ecosystems and startups challenge legacy frameworks, the focus sharpens on experiential retail, sustainability and data-driven personalisation.

SORORITY OF WOMEN OF METTLE

Awinter afternoon in mid-December found quite a crowd at the Oxford Book Store on Connaught Place, as bibliophiles congregated at a corner to listen to three women authors, diverse in their passions, but drawn together by an urge to tell their story.

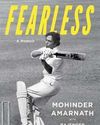

THE LEGACY OF THE AMARNATHS

IN NOVEMBER 2017 the management committee of the Delhi Cricket Association named the eastern stand of the Feroze Shah Kotla ground the Mohinder Amarnath stand.

PUTTING THE POWER IN THE POWERHOUSE

The Asus ExpertBook P5 is powered by an 8-core 8-thread Intel Core Ultra 7 Series 2 processor that clocks a maximum speed of 4.8 GHz, but it does not have hyperthreading. It is light weight, with a smooth glass touch pad. The laptop almost has all the I/O ports you could possibly need in a business laptop, making it an extremely lucrative option for professional computing, says

"We must be aware of our energy and water consumption"

BW Businessworld caught up with actor, philanthropist, and climate warrior BHUMI PEDNEKAR to chat about climate change and more.

"Cooking is a passport to the world"

In conversation with renowned CHEF MANJIT GILL, Advisor at Kikkoman India and President, Indian Federation of Culinary Associations (IFCA). As the former Corporate Chef of ITC hotels, Chef Gill has helped shape iconic restaurants, such as the Bukhara, Dum Pukht, and Dakshin. He has had the privilege of serving former American Presidents Barack Obama, Bill Clinton, George Bush, and the French, Canadian, British and German premiers. In 1992, Chef Gill had the opportunity of being invited to cook for Prince Charles and Lady Diana, at the Palace of the Maharaja of Jaipur. He was awarded the Lifetime Achievement Award from the Ministry of Tourism in 2007.

Strengthening Middle Management for Organisational Resilience

WHAT HOLDS AN organisation together in chaos? Is it visionary leadership, cuttingedge strategies, or robust technology?

The Retail Trailblazers

A look at companies that are making a positive impact on India's growing retail sector with their future fit business and marketing strategies.

Driving Conscious Consumerism

VIDIT JAIN, Co-founder of Kindlife, is leading the charge in revolutionising the intersection of technology and conscious consumerism.