Yet, banks contribute a mere 2.1% to this ecosystem, largely dominated by third-party apps. With upcoming caps on these apps' market share, banks have a key opening to leverage their infrastructure, trust, and customer relationships to capture a bigger slice of India's digital payments market.

The Unified Payments Interface (UPI) has significantly transformed how Indians transact, paving the way for a cashless economy. According to the DigiDhan Dashboard, UPI accounted for 69.6% of all digital payment transactions by volume in India during FY 2023-24. It has become the most preferred mode of payments, processing 20.6 lakh crore across 14,863 crore transactions in August 2024 alone. This marks a nearly 31% increase in the value of transactions and a 40% increase in transaction volume compared to the previous year. UPI continues to make digital payments faster and more accessible, driving financial inclusion across both urban and rural regions.

In August 2024, this growth is driven by a leading few players contributing to more than 90% in terms of volume of transactions has raised concerns regarding market and Technology concentration. It is because UPI enables free instant payments, discouraging other players from promoting it aggressively due to a lack of revenue generation.

To address this issue, the National Payments Corporation of India (NPCI) proposed a 30% volume cap on Third-Party App Providers (TPAPs) in November 2020. UPI players were initially given two years to limit their market share to 30%. Although the original deadline was set for December 2022, it has since been extended for another two years to the end of 2024. Despite this extension, there has been limited progress toward implementing the cap so far.

Diese Geschichte stammt aus der November 2024-Ausgabe von DataQuest.

Starten Sie Ihre 7-tägige kostenlose Testversion von Magzter GOLD, um auf Tausende kuratierte Premium-Storys sowie über 8.000 Zeitschriften und Zeitungen zuzugreifen.

Bereits Abonnent ? Anmelden

Diese Geschichte stammt aus der November 2024-Ausgabe von DataQuest.

Starten Sie Ihre 7-tägige kostenlose Testversion von Magzter GOLD, um auf Tausende kuratierte Premium-Storys sowie über 8.000 Zeitschriften und Zeitungen zuzugreifen.

Bereits Abonnent? Anmelden

The T in RealTy

Hyper-personalised home buying and renting experiences? E-tours? E-signatures? Digital bookings? Why? How? Technology cannot be used as a varnish when one faces old plastered walls like unorganised agents, lack of ecosystem tech-literacy, fragmentation, complex regulation, balancing hyper-personalisation with anonymisation and still ushering customers towards virtual tours, AR, VR, AI magic and personal touch. Let's take a tour with Sangeet Aggarwal, Head of Product at HOUSING.COM, PropTiger.com

Democratizing Al, challenging norms, and shaping the future of global innovation

I sat down with DeepSeek for a candid conversation about its rise, its vision, and its potential to redefine the AI landscape. From democratizing AI to challenging the status quo of the Western tech world, this Q&A delves into the heart of what makes DeepSeek a game-changer.

Are leaders ready to bridge the innovation-trust gap?

AI is no longer the future-it's the now. However, as organizations race to integrate AI into their operations, a fundamental question looms: how can businesses balance rapid innovation with trust and security? Nate MacLeitch, CEO of QuickBlox, weighs in.

Preparing leaders for the AI Era

The term “Management Education” often conjures images of dusty case studies and rigid classroom hierarchies.

GCCs on a Drum-roll in India: Hence, Zimmer

The IT riff here used to win only Emmys and Grammys in, and for adding to, global orchestras of outsourcing, application development and back-office work. Not anymore. It’s time for business Oscars. With GCCs.

RegTech: Because even compliance deserves a tech upgrade

The business environment is getting increasingly complex in India as the country embraces its digital future. From data privacy to digital lending norms and strict anti-money laundering measures, regulators in the country have increased their efforts to make sure there is transparency, accountability, and protection in this age of rapid technological innovation.

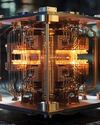

Supercomputing on Ojammpic!

Would Quantum breakthroughs and AI Supercomputers finally make the elusive super-machine affordable, accessible and lean enough to sit happy next to your coffee mug?

Automation means handshakes

If RPA is the backbone, ATI is the brain. Say hello to some new digital white-aprons, fewer insurance frauds and easier preventive-medicine efforts. Vijayashree Natarajan, SVP Head of Technology, Omega Healthcare dissects AI’s new-and-exciting limbs as she argues that AI augments and complements RPA.

How open AI DeepSeek will likely disrupt the market

Jaspreet Bindra, Founder of AI&Beyond and Tech Whisperer Ltd, gives us a ringside view of the changes taking place as a result of DeepSeek entering the market. Excerpts from a freewheeling video interview.

Why cyber insurance is a lifeline for enterprises

While some businesses still believe they’re too small to be hacked,” Tata AIG’s Najm Bilgrami politely disagrees. The company has redefined the sector with its latest product, CyberEdge, which not only insures against cyber risks but also offers a comprehensive ecosystem of prevention, response, and risk improvement services.