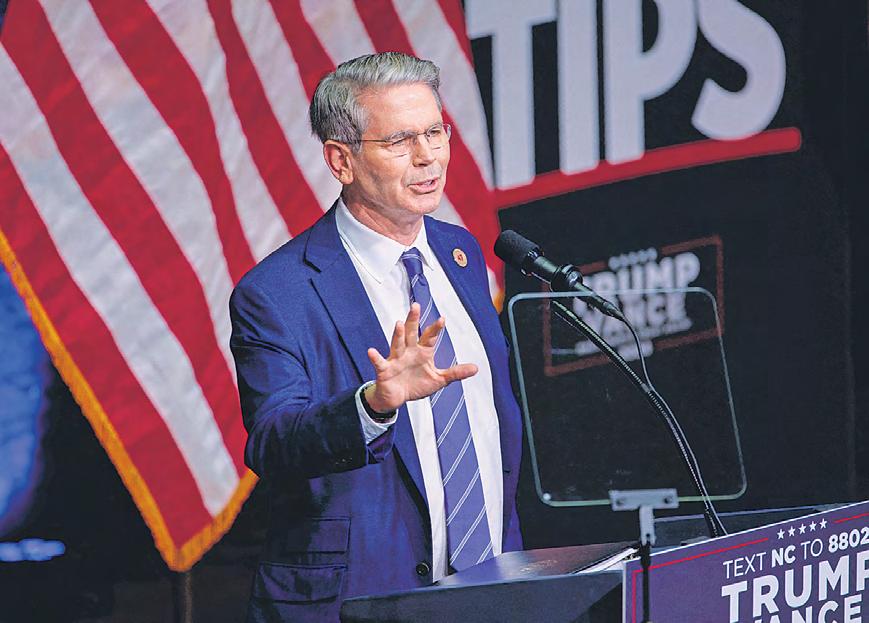

Scott Bessent spent the past 40 years studying economic history. Now, as Donald Trump's choice to lead the Treasury Department, he has the chance to make his mark on it.

As a hedge-fund manager, first at George Soros's firm and later at his own, Bessent specialized in macro investing, or analyzing geopolitical situations and economic data to wager on big-picture market moves. He generated billions of dollars in profits betting on and against currencies, interest rates, stocks and other asset classes around the world.

He was motivated to step out from behind his desk and get involved with Trump's campaign in part because of a view that time is running out for the U.S. economy to grow its way out of excessive budget deficits and indebtedness.

Around 4:30 p.m. on Friday, Trump called Bessent at his Palm Beach hotel, telling him he was Trump's choice. Bessent left for Mar-a-Lago Club to join Trump, Vice President-elect JD Vance and incoming chief of staff Susie Wiles, where they shook hands and discussed policy strategy.

In his first interview following his selection, Bessent said his policy priority will be to deliver on Trump's various tax-cut pledges. Those include making his first-term cuts permanent, and eliminating taxes on tips, social-security benefits and overtime pay.

Enacting tariffs and cutting spending will also be a focus, he said, as will be "maintaining the status of the dollar as the world's reserve currency."

Bessent became one of Trump's closest advisers by adding depth to his economic proposals and defending his plans for more activist trade policies. He has argued that the president-elect's plans to extend tax cuts and deregulate parts of the U.S. economy would create an "economic lollapalooza."

Diese Geschichte stammt aus der November 26, 2024-Ausgabe von Mint Mumbai.

Starten Sie Ihre 7-tägige kostenlose Testversion von Magzter GOLD, um auf Tausende kuratierte Premium-Storys sowie über 8.000 Zeitschriften und Zeitungen zuzugreifen.

Bereits Abonnent ? Anmelden

Diese Geschichte stammt aus der November 26, 2024-Ausgabe von Mint Mumbai.

Starten Sie Ihre 7-tägige kostenlose Testversion von Magzter GOLD, um auf Tausende kuratierte Premium-Storys sowie über 8.000 Zeitschriften und Zeitungen zuzugreifen.

Bereits Abonnent? Anmelden

Trump Team Explored Simplified Plan for Reciprocal Tariffs

Mexico Would Wait Until April 2 and Then Decide Whether to Impose Retaliation to Trump's Tariffs, Sheinbaum Said

Measures for IndusInd hinge on PwC report

A shok Hinduja, chairman of the promoter company of IndusInd Bank Ltd, has said that the private lender does not require capital and all measures to bolster the credibility of the bank after it disclosed accounting discrepancies will depend on PwC's external audit report.

Zudio, Trent's greatest strength, may also be its biggest weakness

Growing pains

Why this state-run lender is courting lower-rated clients

With few 'AAA' and 'AA' firms, banks must tap lower-rated borrowers to grow, said a rating agency analyst

Amid 5G rollout, Vodafone Idea caught in satnet FOMO

Telco weighs satellite internet options, even as rivals Jio, Airtel push ahead with partnerships

Is the capital gains tax to blame for the foreign-investor exodus?

It's being offered as an explanation to justify past stories gone wrong but is weak as an argument

Now, CXO hires keep India Inc. guessing

CXO dropouts are frustrating because the lengthy process has to start from scratch, delaying the company's plans. Headhunters are annoyed, too, since they get paid only if the candidate joins and works for a fixed minimum period.

Barclays Invests + ₹2.3k Cr in India Ops

British lender Barclays on Tuesday announced a ₹2,300-crore capital infusion into India operations.

Keep your photography smooth with this handy device

A gimbal is a hand-held stand that steadies your phone, and the Insta360 Flow 2 Pro is among the top ones out there

Capex not at cost of welfare spending

The central government has proposed to achieve a fiscal deficit target of 4.4% of India's GDP for 2025-26