One of the key aspects of the trading and analytical process is the ability to establish accurate future time and price targets.

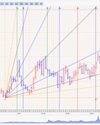

And, although most technical analysis tools attempt to measure the demand for a stock or commodity, or to predict whether price will move up or down and in what time frame, there are precious few tools which can answer both questions at the same time. Below, we’ll focus on two such tools which can help us identify price and time targets with a high level of confidence and accuracy, thus saving the trader/analyst valuable time and effort. Hurst channels were introduced to the trading public by J.M. Hurst in his book “The Profit Magic of Stock Transaction Timing” first published in 1970. Hurst channels fall in the category of forward looking technical analysis (TA) tools, and provide a powerful visual aid for defining a trend and determining the future trading range and support/resistance levels of any instrument in any time frame (Figure 1):

(Figure 1) For example, the daily chart gives price and time targets for next week, the weekly chart for next month, the monthly chart for the next six months, etc. The accuracy of these targets has been tested continuously for many years, and they have outperformed the best of Wall Street research time and again. For user convenience, the OddsTrader app displays the exact dates and prices in a separate data tab, which adds a higher level of clarity.

What makes channels even more useful and user friendly is the fact that they constantly adapt, and with every passing minute, hour or day, give new and revised price and time targets without any additional user input. Moreover, the ability to measure the accuracy of current price action to past price and time forecasts gives users added confidence in their analysis.

Esta historia es de la edición Jan/Feb/Mar 2018 de TradersWorld.

Comience su prueba gratuita de Magzter GOLD de 7 días para acceder a miles de historias premium seleccionadas y a más de 9,000 revistas y periódicos.

Ya eres suscriptor ? Conectar

Esta historia es de la edición Jan/Feb/Mar 2018 de TradersWorld.

Comience su prueba gratuita de Magzter GOLD de 7 días para acceder a miles de historias premium seleccionadas y a más de 9,000 revistas y periódicos.

Ya eres suscriptor? Conectar

Review of Trading Market Dynamics Using Technical Analysis by Constance M. Brown, CFTE, MFTA

The author, Constance Brown is a well-known experienced trader and technical analyst. She has written several articles for Traders World. She has written a top notch book which you can learn and understand technical analysis from.

WealthCharts Continues to Evolve With New Features and the Champion Trend Pack Indicators

In the April/May/June 2021 edition of TradersWorld magazine, I took my first look at one of the newer trading platforms to come on the market, WealthCharts, and I was impressed by the number of cutting-edge features it contained for active traders and investors.

THE YEAR OF 144, W.D.GANNS BIRTHDAY

Very few people are really doing anything like what Gann was studying, they aren't going back far enough, daily trading isn't what Gann was doing, yet every person in the world is claiming this is Gann's secret, especially all the 24 year olds from India, called 3 books astrologers. Gann was a long term researcher.

Maintaining Emotional Control When the Money is Real

People (including traders) like to believe that they are rational beings who have to deal with emotions.

Quantitative Approach

Being aware of one's surroundings is consciousness. This is what we believe our formula conveys. It presents market movement in the future ahead of market moving events. This also happens as markets approach Fibonacci numbers. We recognize this as a prequel to Fibonacci numbers overall.

Time will tell

The year 2022 was forecasted to take a turn for the better as we have forecasted already in May 2021, based on the Long term Time patterns we have calculated for the future and beyond.

What I Learned Trading Through Four Bear Markets

On Tuesday June 14, CNBC declared the Pandemic Bull dead and announced that a new Bear market has begun. Two questions came to mind.

The Human Factors of Trading and How To Control Them

Let me start by introducing myself. I am a full-time trader, trainer, and software developer in the futures markets.

How to Use Smart Momentum Like a Pro

In our last article of Trader's World (Issue 84), we covered ten key concepts using Momentum for trading. We also covered various definitions of trading Momentum and various general applications.

How Market Timing Gives You The Critical Edge

The Market Timing Report