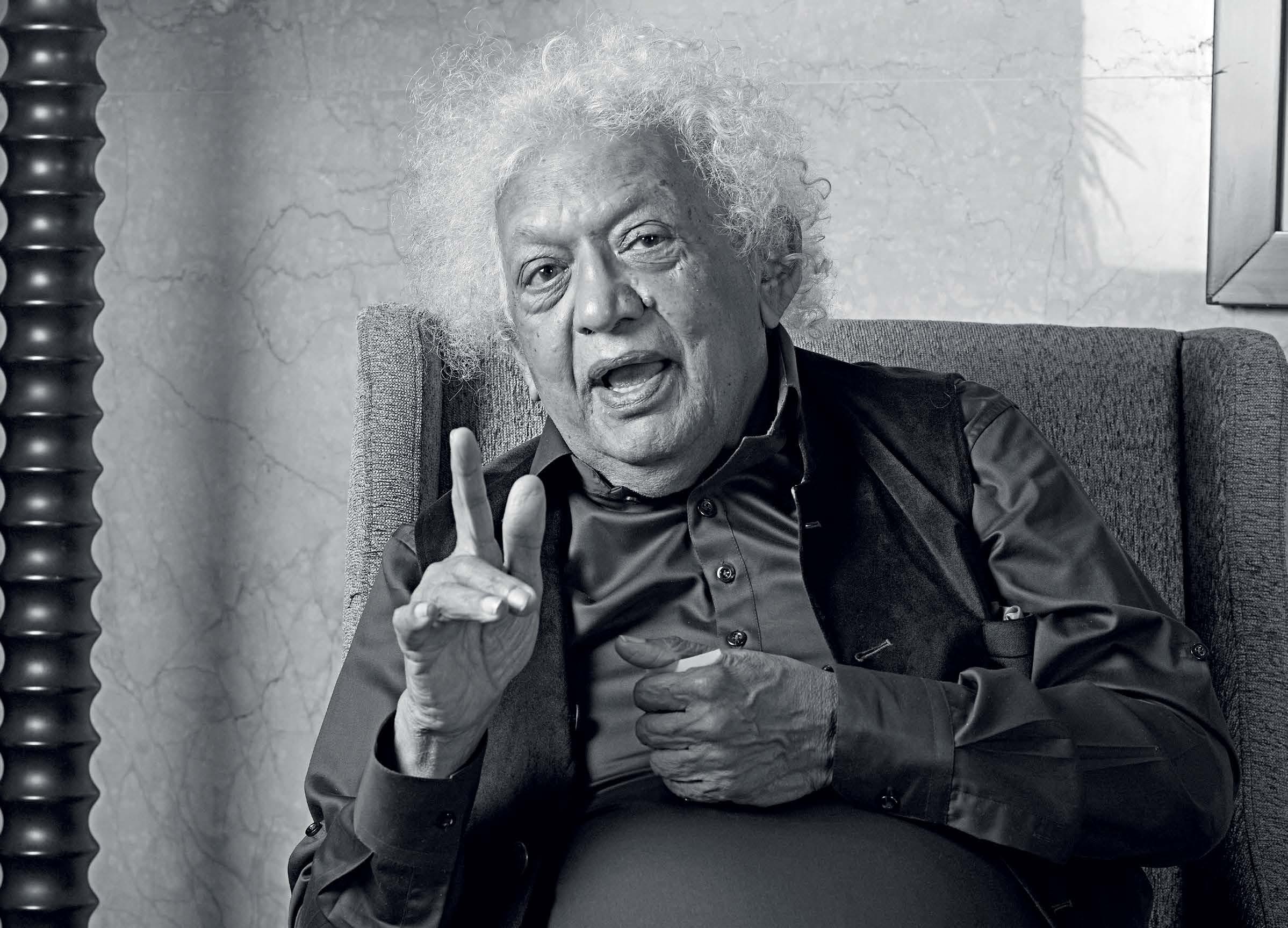

Meghnad Desai, known for his frank views on the state of the economy, says the world is looking at tough times. An Emeritus Professor of Economics at the London School of Economics and Political Science (LSE), Desai believes that India should concentrate on its creamy layer of 200 million people as the growth of these wealthy individuals will propel the economy and lift the bottom 40 per cent out of poverty. The 82-year-old, who sits on the board of Elara Capital, says that economics is all about people's lives and livelihoods, and not about debt-to-GDP ratios or deficit finance. In an interaction with Business Today's Anand Adhikari, Desai speaks on a host of issues confronting India. Edited excerpts:

Q: What impact do you see of historically high global inflation and high interest rates on emerging markets, including India?

A: I hold a somewhat unorthodox view. I lived through the previous stagflation crisis of the 1970s. It was very similar because oil prices had quadrupled in 1973. The OPEC countries, which had not changed the price of oil since 1918, after 55 years decided to increase prices. At that time, many people said that this monopoly would never last, and that there would be competition. It, however, totally changed the whole paradigm of economics and of the global economy. The oil price rise didn't end for 20 years. Inflation went up to 22 per cent in England. Margaret Thatcher [became PM] in 1979, and she let all the pain be inflicted. She had a simple view: inflation cannot go unless you inflict pain on the public. This is what monetary policy is all about. It was about deflating the economy until the economy stopped growing and people stopped buying or bought the [bare] minimum. And that’s how inflation gets out of the system.

Esta historia es de la edición November 13, 2022 de Business Today India.

Comience su prueba gratuita de Magzter GOLD de 7 días para acceder a miles de historias premium seleccionadas y a más de 9,000 revistas y periódicos.

Ya eres suscriptor ? Conectar

Esta historia es de la edición November 13, 2022 de Business Today India.

Comience su prueba gratuita de Magzter GOLD de 7 días para acceder a miles de historias premium seleccionadas y a más de 9,000 revistas y periódicos.

Ya eres suscriptor? Conectar

"Inaction is worse than mistakes"

What was the problem you were grappling with?

TEEING OFF WITH TITANS

BUSINESS TODAY GOLF RESUMES ITS STORIED JOURNEY WITH THE 2024-25 SEASON OPENER IN DELHI-NCR. THERE ARE SIX MORE CITIES TO COME

AI FOOT FORWARD

THE WHO'S WHO OF THE AI WORLD GATHERED AT THE TAJ MAHAL PALACE IN MUMBAI TO DELIBERATE THE TRANSFORMATIVE IMPACT OF AI ON INNOVATION, INDUSTRIES, AND EVERYDAY LIFE.

Decolonising the Walls

ART START-UP MAAZI MERCHANT IS ON A MISSION TO BRING INDIA'S FORGOTTEN ART BACK HOME

"I'm bringing Kotak under one narrative, one strategy, one umbrella”

Ashok Vaswani is a global banker who spent most of his career overseas at institutions like Citi Group and Barclays, among others.

CHOOSING THE CHAMPIONS

The insights and methodology behind the BT-KPMG India's Best Banks and NBFCs Survey 2023-24.

'INDIA IS AT AN EXTREMELY SWEET SPOT'

The jury members of the BT-KPMG Survey of India's Best Banks and NBFCs discuss developments in the banking sector and more

FROM CRISIS TO TRIUMPH

Dinesh Kumar Khara stewarded SBI through multiple challenges during his tenure, while ensuring that profits tripled, productivity soared, and the bank consolidated its global standing

AT A CROSSROADS

BANKS ARE FACING CHALLENGES ON BOTH SIDES OF THE BALANCE SHEET-ASSETS AS WELL AS LIABILITIES-WHICH ARE PUTTING PRESSURE ON MARGINS.

EXPANSIVE VISION

Bajaj Finance, an outlier in terms of digitisation, faces stiff competition. But it continues to expand its reach