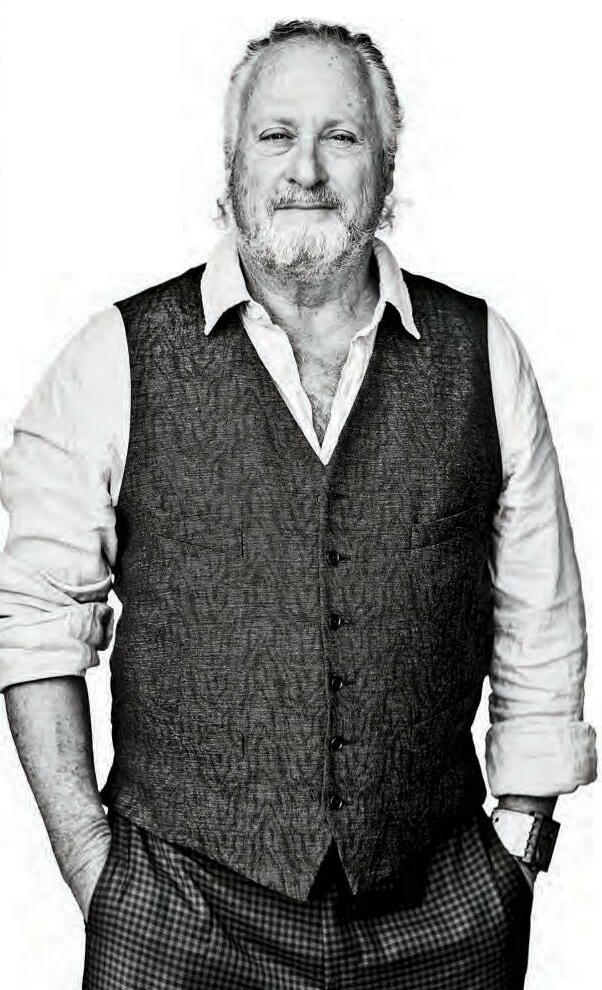

Robert Wilder, 62: author, lecturer, organic gardener, tree hugger. Something of a hippie? No, this ecologist is a financier, with a sharp eye for how to turn environmentalism into a business.

Wilder is the owner of the stock index that dictates the portfolio of Invesco Wilder Hill Clean Energy. The exchange-traded fund holds $930 million worth of shares in 82 companies betting on the transition away from carbon. They make things like charging stations, windmill blades and parts for renewable-energy grids. "Speculative" is an understatement for these outfits, most of them in the red. Will Energy Vault ever be able to economically store energy by lifting giant blocks? There are skeptics.

Investors would be hard pressed to find a wilder ride among investment companies. In 2020, the fund was up 206%. Since then it has evaporated half its customers' money. At this point the portfolio's companies are, if not bargains, at least on sale. They will presumably prosper if some of the $394 billion Congress recently approved for carbon reduction trickles down to them.

In the 1990s Wilder was a Ph.D. lecturing on environmental science at state universities in Massachusetts and California. There wasn't enough excitement in that. He says, "Being a professor is the second-best thing to do. The best thing is to be an entrepreneur."

Wilder quit his academic career, drained his retirement account and visited fund operators in Boston and New York with a proposal for a green-energy fund. "They laughed at me," he says. At one point he was making ends meet by collecting unemployment benefits.

Eventually, an ETF vendor now part of Invesco signed up. Wilder would pick the companies for a green energy index; the fund company would use this index to create a fund, handling the accounting and the Wall Street connections. ("Hill" refers to an early participant who has backed away; Wilder owns WilderShares LLC outright.)

Esta historia es de la edición December 2022 - January 2023 de Forbes US.

Comience su prueba gratuita de Magzter GOLD de 7 días para acceder a miles de historias premium seleccionadas y a más de 9,000 revistas y periódicos.

Ya eres suscriptor ? Conectar

Esta historia es de la edición December 2022 - January 2023 de Forbes US.

Comience su prueba gratuita de Magzter GOLD de 7 días para acceder a miles de historias premium seleccionadas y a más de 9,000 revistas y periódicos.

Ya eres suscriptor? Conectar