MUMBAI: The Reserve Bank on Monday said asset quality of banks improved further and their gross non-performing assets (GNPA) or bad loans ratio declined to a 12-year low of 2.6 per cent in September 2024 on the back of falling slippages and steady credit demand.

The RBI also flagged concern over a sharp rise in write-offs, especially among private sector banks (PVBs), which could be partly masking worsening asset quality in unsecured lending segment and dilution in underwriting standards.

The net NPA ratio or the proportion of net non-performing assets in net loans and advances was at around 0.6 per cent, according to the RBI's December 2024 issue of the Financial Stability Report (FSR).

Esta historia es de la edición December 31 2024 de Millennium Post Delhi.

Comience su prueba gratuita de Magzter GOLD de 7 días para acceder a miles de historias premium seleccionadas y a más de 9,000 revistas y periódicos.

Ya eres suscriptor ? Conectar

Esta historia es de la edición December 31 2024 de Millennium Post Delhi.

Comience su prueba gratuita de Magzter GOLD de 7 días para acceder a miles de historias premium seleccionadas y a más de 9,000 revistas y periódicos.

Ya eres suscriptor? Conectar

Kriti explains why 'Jab We Met' is an iconic film

She was seen in the streaming movie 'Do Patti'

Armaan and Aashna are finally married

Singer Armaan Malik is finally married to his longtime girlfriend and influencer, Aashna Shroff.

Gainda: Exploring themes of conformity, identity & resistance

The minimalist set design reflects the emptiness and alienation central to the play's themes

Shahid bags a 'raw' deal with 'Deva'

The action film is undoubtedly a highly anticipated project of 2025

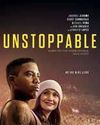

Jennifer Feels Subject of 'Unstoppable' Deserves All Attention

The sports drama has been earning awards buzz

Long rope for Rohit nears end?

Gambhir refuses to confirm skipper's place in XI; retirement rumours rife

Merciless Aussies to step on gas in Sydney, says Cummins

MARSH DROPPED, STARC DECLARED FIT

Bumrah, Dravid missing from National Sports Awards list

Decision bound to raise eyebrows

UPI transactions rise 8% to 16.73 billion in Dec: NPCI

Transactions through the popular Unified Payments Interface (UPI) touched a record 16.73 billion in December, recording a growth of 8 per cent over the preceding month, according to data released by the National Payments Corporation of India (NPCI).

India-EFTA pact likely to be implemented before 2025 end

European Free Trade Association members are Iceland, Liechtenstein, Norway & Switzerland