CATEGORIES

PRIVATE COMPANY ROCKETS TOWARD THE MOON IN THE LATEST RUSH OF LUNAR LANDING ATTEMPTS

A private company launched another lunar lander Wednesday, aiming to get closer to the moon's south pole this time with a drone that will hop into a jet-black crater that never sees the sun.

C1 Modem

A GROUNDBREAKING REVOLUTION PAVING THE WAY TO APPLE'S FUTURE

NVIDIA SALES SURGE IN THE FOURTH QUARTER ON DEMAND FOR AI CHIPS

Nvidia on Wednesday reported a surge in fourth-quarter profit and sales as demand for its specialized Blackwell chips, which power artificial intelligence systems, continued to grow, sending the company's stock higher after hours.

GOOGLE MAPS ROLLS OUT ADS: $11 BILLION REVENUE PUSH BEGINS

Google Maps flipped the switch on ads globally this week, launching a monetization drive on February 19, 2025, that Alphabet hopes will rake in $11 billion annually.

TOP APPLE EXEC CONCEDES HE HAD DOUBTS ABOUT APP STORE FEES IMPOSED ON ALTERNATIVE PAYMENT OPTIONS

Longtime Apple executive Phil Schiller this week conceded he initially opposed fees that the iPhone maker charges for in app-transactions processed outside its own payment system because he feared violating a court-ordered mandate designed to create more competition.

Migrants With No Criminal History Swept Up

Immigration officers are under pressure to ramp up their arrest numbers

The Loneliest Democrat in Washington

The Pennsylvania senator was going to be a bomb-throwing left-winger. Then he almost died of a stroke.

Why Teens Love a $10 Hand Sanitizer

Touchland's mists have become a status symbol among teens and tweens—and a popular item to trade at schools

AI Could Usher In a New Renaissance

It is already better than human intelligence at some tasks. It may become capable of new discoveries.

Hiding on the Silver Screen

Merle Oberon kept her South Asian origins a secret from the movie industry and audiences.

Just Add Water. No, Really.

Instant coffee has come a long way. Here, the next-generation brands worth brewing.

Paris's Enchanting Isle

Most tourists treat the Île Saint-Louis as a pit stop while crossing the Seine. But an infusion of new energy is turning the storied enclave into a chic destination in its own right.

Tiny But Mighty Good

Drinking less isn't the only impetus behind these downsized cocktails. They're about drinking better.

Chinese Manufacturers Prepare for New Tariff Hit

Cui Shu, a lawyer in the southeastern Chinese city of Xiamen, was working in his office when a flurry of calls and text messages arrived from clients, frantically seeking guidance about President Trump's latest proposal, delivered by social media post hours earlier: an additional 10% tariff on all Chinese imports.

Don't Let a Scam Artist File Your Taxes For You

Victims of tax identity theft may find themselves waiting two years for the IRS to resolve their cases. Here's how to protect yourself.

Treatments Offer Hope On Pancreatic Cancer

Pranathi Perati was running out of time to treat her stage-four pancreatic cancer when she found out she would get another shot: a clinical trial testing a new experimental drug.

Studying London Cabdrivers Made Her a Neuroscience Star

Her widely hailed research showed that, even in adulthood, the human brain can adapt and change.

Novelist Curtis Sittenfeld Thinks Middle Age Is Underrated

The author, whose new collection of short stories is out this week, has the same advice for being a good writer and a good person.

University of Alabama's First Black Faculty Member

As a barrier breaker in education, he was stoic about facing dehumanizing behavior, but felt it all. \"There were times I felt like, I don't want to go back out there.\"

Can Elon Musk Avoid The Chainsaw Curse?

Elon Musk is providing a fresh opportunity to test whether the chainsaw indicator rises to the level of a bona fide curse, on par with the stadium curse.

Trump-Zelensky Meeting Implodes

U.S. president scolds Ukrainian leader, leaves proposed deal on minerals unsigned

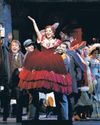

Why 'Bohème' Endures

AMONG THE MOST goose-bump-inducing moments in opera is Mimì's entrance in the duet that concludes the first act of Giacomo Puccini's 1896 opera \"La Bohème.\" Rodolfo (tenor), a struggling poet, has found his muse in the poor, tubercular seamstress-grisette Mimì (soprano); his vocal crescendo ignites her into joining him in a mutual declaration of love.

Inside DOGE's Federal Takeover

A surprise incursion, shrouded in secrecy; 'rogue bureaucrats' fight back

Can White Men Finally Stop Complaining?

For 50 years, we've been hearing from men who feel threatened by the gains of women and minorities. Now that the manosphere is in charge, the victim mentality has to go.

Microsoft to Shut Skype, Shift to Teams

The tech giant is hanging up on the communication service in May

The Passive-Aggressive Doughnuts That Tanked a Job Interview

Your future employer doesn't want to know how you sabotaged your current boss's weigh-loss effort

KATY PERRY AND GAYLE KING WILL JOIN JEFF BEZOS' FIANCEE LAUREN SANCHEZ ON BLUE ORIGIN SPACEFLIGHT

Katy Perry and Gayle King are headed to space with Jeff Bezos' fiancee Lauren Sanchez and three other women.

AMAZON EXPANDS DRONE DELIVERY TO 10 U.S. CITIES: AWS FUELS LOGISTICS

Amazon took flight this week, expanding its Prime Air drone delivery to 10 U.S. cities on February 21, 2025, powered by AWS artificial intelligence.

CONNECTICUT LAWMAKERS BACK PROHIBITION ON STATE AGENCIES AND LOCAL GOVERNMENTS USING FOREIGN DRONES

Connecticut lawmakers passed emergency legislation prohibiting state agencies and municipalities from purchasing or using Chinese and Russian drones while also imposing restrictions on where drones can be operated in the state.

GETTING A LOT OF UNWANTED PHONE CALLS? HERE ARE WAYS TO STOP THEM

Unwanted phone calls are out of control. Whether it's a robocall trying to sell you something or spam calls from scammers trying to rip you off, it's enough to make you want to stop answering your phone. So what can you do to stop them?