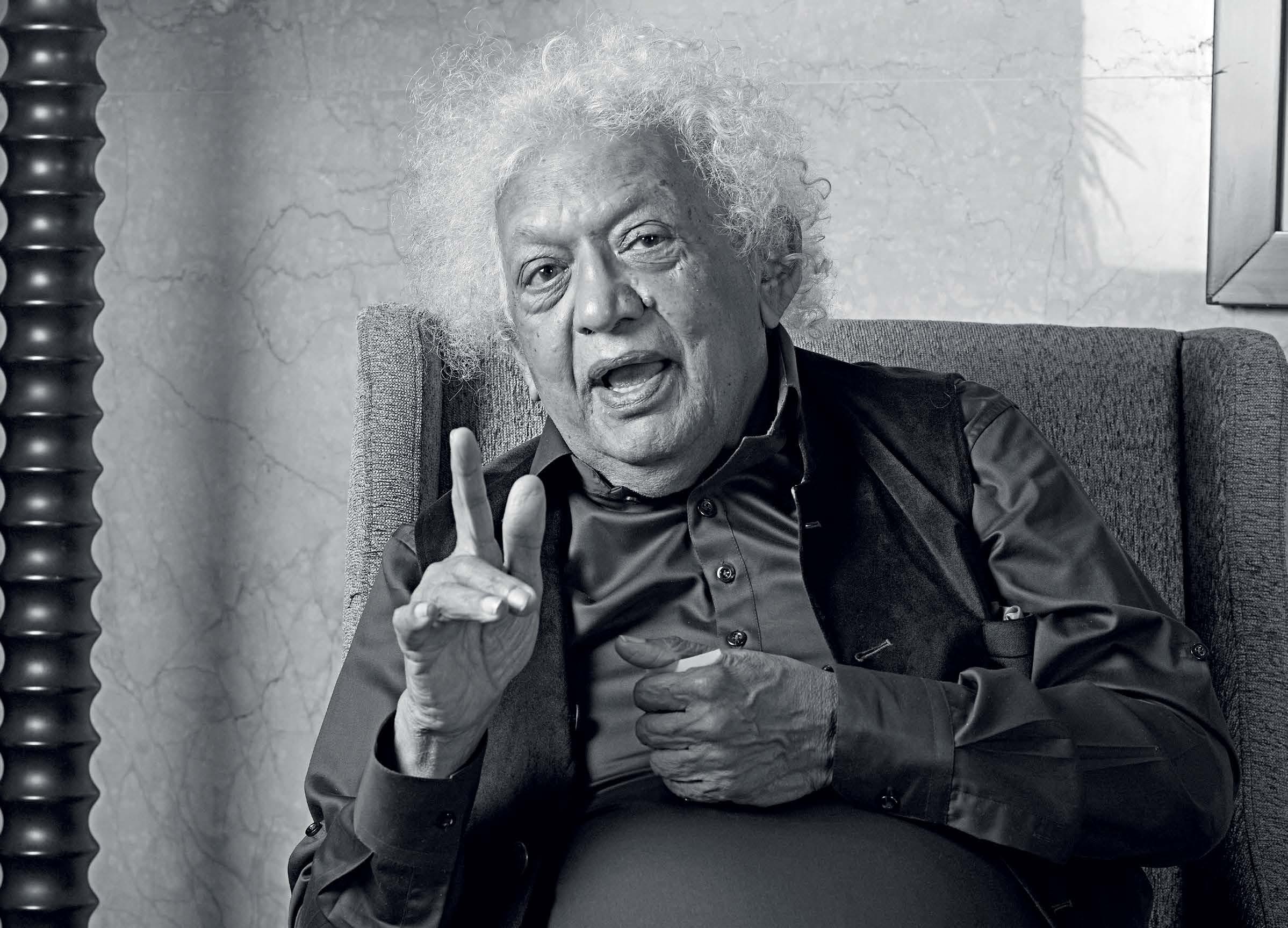

Meghnad Desai, known for his frank views on the state of the economy, says the world is looking at tough times. An Emeritus Professor of Economics at the London School of Economics and Political Science (LSE), Desai believes that India should concentrate on its creamy layer of 200 million people as the growth of these wealthy individuals will propel the economy and lift the bottom 40 per cent out of poverty. The 82-year-old, who sits on the board of Elara Capital, says that economics is all about people's lives and livelihoods, and not about debt-to-GDP ratios or deficit finance. In an interaction with Business Today's Anand Adhikari, Desai speaks on a host of issues confronting India. Edited excerpts:

Q: What impact do you see of historically high global inflation and high interest rates on emerging markets, including India?

A: I hold a somewhat unorthodox view. I lived through the previous stagflation crisis of the 1970s. It was very similar because oil prices had quadrupled in 1973. The OPEC countries, which had not changed the price of oil since 1918, after 55 years decided to increase prices. At that time, many people said that this monopoly would never last, and that there would be competition. It, however, totally changed the whole paradigm of economics and of the global economy. The oil price rise didn't end for 20 years. Inflation went up to 22 per cent in England. Margaret Thatcher [became PM] in 1979, and she let all the pain be inflicted. She had a simple view: inflation cannot go unless you inflict pain on the public. This is what monetary policy is all about. It was about deflating the economy until the economy stopped growing and people stopped buying or bought the [bare] minimum. And that’s how inflation gets out of the system.

This story is from the {{IssueName}} edition of {{MagazineName}}.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber ? Sign In

This story is from the {{IssueName}} edition of {{MagazineName}}.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber? Sign In

"Focus on the challenge of each customer"

SHASHANK KUMAR MD & CO-FOUNDER I RAZORPAY Razorpay is India's first full-stack financial solutions company

PEDAL ON THE FUTURE

THE MG WINDSOR EV, WITH ITS FUTURISTIC AND MINIMALIST DESIGN, COMBINES THE BEST OF BOTH WORLDS-COMFORT AND TECHNOLOGY

BREATHE EASY

Whether you're battling allergies, looking to remove pollutants, or simply want to breathe easier, the right air purifier can make a difference

The Taste of India in a Glass

FROM ROYAL LIQUEURS TO DISTILLED MAHUA, INDIAN HERITAGE ALCOHOLIC BEVERAGES ARE HAVING THEIR DAY IN THE SUN

LOOK BEFORE YOU LEAP

IN 2025, INVESTORS WILL NEED TO FACTOR IN VOLATILITY ACROSS ASSET CLASSES

MISSING ADVISORS

INDIA HAS JUST ONE INVESTMENT ADVISOR FOR NEARLY EVERY 200,000 INVESTORS. AT A TIME WHEN RETAIL PARTICIPATION IN THE STOCK MARKETS IS BOOMING, THIS ASSUMES SIGNIFICANCE

TURNING A CORNER

SHARED ELECTRIC MOBILITY START-UP YULU'S SHIFT TO SERVICING THE QUICK COMMERCE SECTOR IS HELPING IT GROW FAST. IT IS NOW FOCUSSING ON IMPROVING ROAD SAFETY FEATURES AS IT TURNS EBITDA POSITIVE

REALITY CHECK

INDIAN STOCK MARKETS PLUNGED BEGINNING OCTOBER FOR A HOST OF REASONS, INCLUDING A FALL IN FII OWNERSHIP. HOW DEEP WILL THE CORRECTION BE?

TRUMP'S TRADE TANGO

The return of Donald Trump as the 47th President of the US has put the global economy on edge. India, too, is unlikely to remain unaffected. How will policymakers meet this latest challenge?

"The essence of the Trump administration will be transactional”

Global investor, analyst, and best-selling author Ruchir Sharma decodes why Donald Trump won the elections, what India should do, the risks, and more