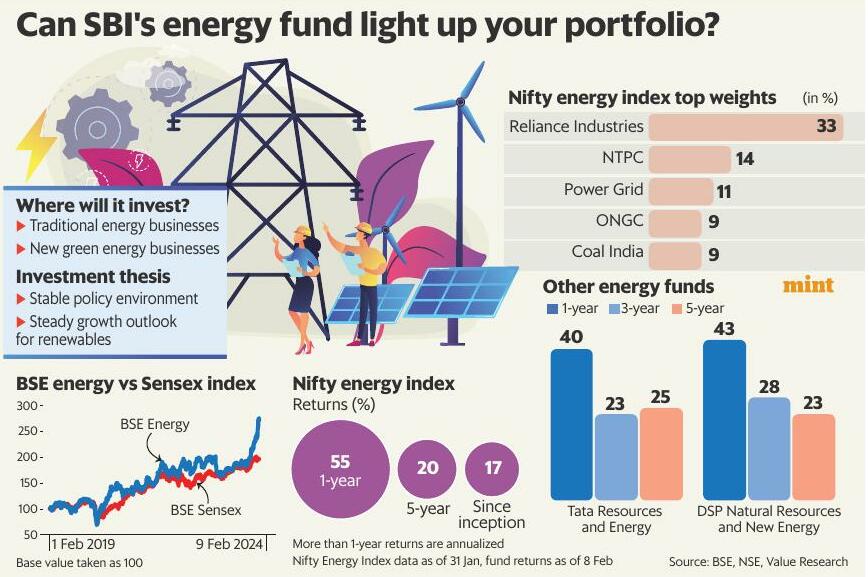

India's energy landscape seems to be getting some fairly deserved attention, particularly from fund houses. India's largest fund house-SBI Mutual Fundrecently launched a thematic fund focused on the energy space. The SBI Energy Opportunities Fund will invest in stocks that belong to the energy sector to take advantage of rising energy demand.

How it works The fund will invest in a mix of traditional and new energy businesses.

"Traditional energy companies are incubating new energy businesses.

Because of policy reforms, the profit pools of traditional energy companies are increasing and it is much more predictable. And that will lead to value creation, when this new cash flow is put to use for new energy business," says Raj Gandhi, fund manager at SBI MF.

To be sure, oil and gas exploration and production giant Reliance Industries has planned ₹75,000 crore of capex for new energy business.

Recently, oil producer ONGC and power firm NTPC entered into a joint venture agreement to set up offshore wind energy projects.

The SBI fund will be benchmarked against the Nifty Energy Index, which has delivered 20% annualized returns over a five-year period (as of 31 January), as against 14.9% annualized returns delivered by Nifty 50 Index in the same period.

This story is from the {{IssueName}} edition of {{MagazineName}}.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber ? Sign In

This story is from the {{IssueName}} edition of {{MagazineName}}.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber? Sign In

Reduction of energy costs in the telecom sector

With telecom infrastructure companies looking for newer ways to cut back on energy costs, battery restoration technology provides telecom infrastructure firms with a viable, economical and green solution for uninterrupted power supply

Skip cheese and sip wine in Switzerland

Beyond chocolates and cheese, there's another Swiss gem to discover — vineyards that have been passed down through the generations

Bankers aren't always frank about bank regulation

The 'world's banker' Jamie Dimon, CEO of JPMorgan Chase, speaks his mind even if it means taking swipes at US regulators.

Baku: A climate breakthrough looks depressingly bleak today

The success of fossil fuel-favouring politics threatens the planet

Global solidarity levies can play a vital role in our climate efforts

Solidarity taxes could support redistributive measures and optimize how we collectively tackle a great challenge of our times

Speak for the Earth: It's the least we should do

This year's Booker prize winner turns our gaze to the planet from orbit and reminds us of the climate disaster that looms. Can odes sung to Earth move the world to act in its defence?

Aim for an efficient carbon market right from the start

India's economy is projected to grow dramatically over the next few decades. In nominal terms, it may double in size by 2030. This is exciting, but it comes with a significant risk.

Why health insurers refuse to cover certain treatments

While 12 modern treatments are covered, many advanced procedures are yet to be included

Address economic distress with structural reforms and not doles

Cash transfers may offer short-term relief but raising worker incomes is the only lasting solution

FUNDING FOREIGN EDUCATION: SHOULD YOU SAVE OR BORROW?

Education financing needs vary, but early planning is key to building your desired corpus