Last week, at a conference of state power ministers in New Delhi, Union Power Minister M L Khattar urged them to publicly list their profit-making power sector entities. "Those states which have good performing generating or transmission companies (gencos or transcos) and even power distribution companies (discoms) should consider listing them on exchanges," Khattar said. But he juxtaposed it with the worrying statistics of state-owned discoms. "The current cumulative debt of discoms is ₹6.84 trillion, and the accumulated losses stand at ₹6.46 trillion as of now," the minister said.

During 2023-24 (FY24), the cost of power procurement for state-owned discoms increased by 71 paise, according to government data submitted in Parliament. Various reasons have been cited for it—such as imported coal, increased cost of power transmission, and record-high demand.

As discoms pushed all the buttons to meet the record-high demand during FY23, their total debt rose to ₹70,000 crore for funding their capital expenditure, working capital requirement, and operational losses, according to the Annual Integrated Ranking and Rating report of the PFC earlier this year. The report said 16 states had seen their financial losses increase significantly during FY23 (see chart). These include large states such as Uttar Pradesh, Telangana, Maharashtra, Punjab, and Jharkhand.

The debt-loss vortex of discoms could stand to threaten the idea of financing them through public money.

この記事は Business Standard の November 18, 2024 版に掲載されています。

7 日間の Magzter GOLD 無料トライアルを開始して、何千もの厳選されたプレミアム ストーリー、9,000 以上の雑誌や新聞にアクセスしてください。

すでに購読者です ? サインイン

この記事は Business Standard の November 18, 2024 版に掲載されています。

7 日間の Magzter GOLD 無料トライアルを開始して、何千もの厳選されたプレミアム ストーリー、9,000 以上の雑誌や新聞にアクセスしてください。

すでに購読者です? サインイン

CRYING OVER SPILT MILK

From 6.62 in FY18, India’s milk production growth rate has fallen sharply to 3.78% in FY24

The art of leaving

Ravichandran Ashwin, the quintessential cricketing nerd who bamboozled batters through skill, guile, and acumen, stumped fans around the globe on Wednesday when he retired from international cricket with immediate effect at the end of the third Test of the Border-Gavaskar Trophy in Brisbane.

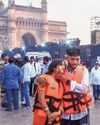

13 dead as Navy speedboat rams into ferry off Mumbai coast

Thirteen persons died and 99 others were rescued after a Navy craft crashed into a ferry off the Mumbai coast on Wednesday, the Navy said.

How senior living market is redefining retirement

With a growing population of India's well-to-do elderly choosing to live well and live free, businesses have spotted an opportunity. The first of a four-part series on the silver economy focuses on luxury housing projects developed with seniors in mind

TRAVEL INSURANCE FOR HOLIDAYERS Sum insured should depend on destination, trip duration, and age

This holiday season, Indian travellers are likely to flock to short-haul destinations.

New coat of opportunity for Berger and Indigo

Analysts see potential in select paint stocks amid entry of big players

Aluminium seen as outlier among metals; Hindalco better placed

Most industrial metals are expected to stay bearish at least in early 2025. However, aluminium could be an exception.

₹ hits fresh low of 84.96 against $

The rupee has depreciated further to close at a fresh low of 84.96 against the US dollar on Wednesday as foreign banks purchased dollars on behalf of their clients ahead of the outcome of the US Federal Reserve meeting, said dealers.

FPI selling ahead of Fed meet drags market down for 3rd day

Overseas investors pull out ₹8,000 crore this week

Bourses see three blockbuster debuts

Mobikwik up 90%; Vishal Mega Mart, Sai Life gain 40%