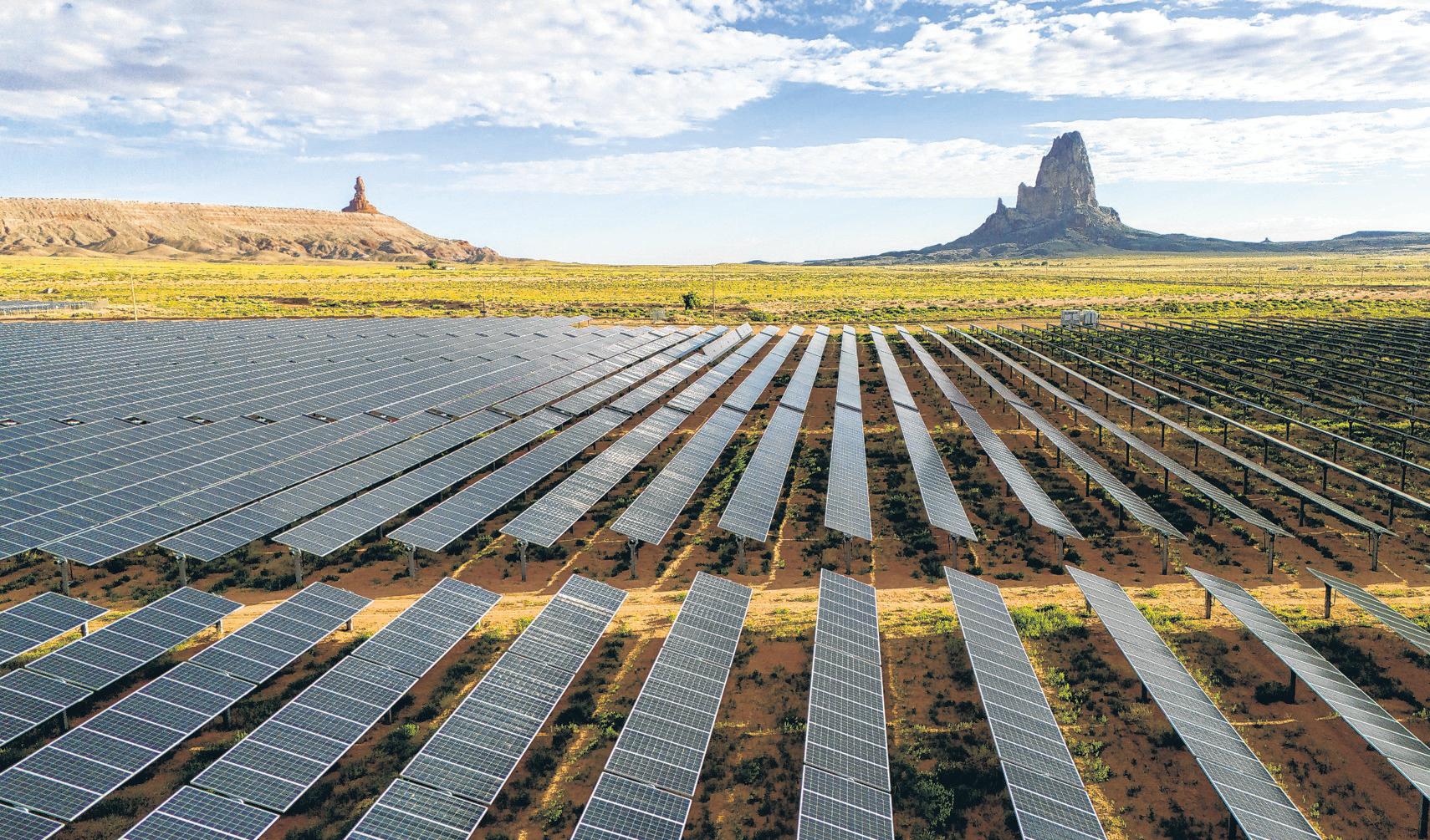

Rising electricity demand coupled with tax incentives for clean energy helped drive private-equity investments in the U.S. renewable-power sector in recent years, according to fund managers. Now, Trump's promises to cut incentives and place tariffs on renewable-energy equipment have raised concerns among investors.

Executives at some privateequity firms, however, expect the new administration to think twice before taking any action that could limit efforts to meet surging electricity demand, no matter its pronouncements on clean energy. Those executives point to the continuing manufacturing boom in the U.S. and the hundreds of billions of dollars that large technology companies plan to invest in artificial intelligence in coming years. Planned factories and Al-optimized data centers will only become reality if there is enough electricity to power them, the firms' leaders said.

"Trump is going to do everything possible to facilitate the development of electricity to support the build-out because the constraining factor is availability of electricity," said Doug Kimmelman, founder and senior partner at Energy Capital Partners. ECP, as the energy-infrastructure investor is known, recently formed a partnership with buyout giant KKR to invest $50 billion in new data centers and power-generation projects worldwide.

この記事は The Wall Street Journal の December 27, 2024 版に掲載されています。

7 日間の Magzter GOLD 無料トライアルを開始して、何千もの厳選されたプレミアム ストーリー、9,000 以上の雑誌や新聞にアクセスしてください。

すでに購読者です ? サインイン

この記事は The Wall Street Journal の December 27, 2024 版に掲載されています。

7 日間の Magzter GOLD 無料トライアルを開始して、何千もの厳選されたプレミアム ストーリー、9,000 以上の雑誌や新聞にアクセスしてください。

すでに購読者です? サインイン