CLIMATE TECHNOLOGY as an attractive asset class for pure-play venture capital (VC) investors, rather than impact funding or environmental, social and governance (ESG) investment targets, has only recently begun to gain traction. To meet its carbon-emissions targets, India will need funding and investment, much of it upfront. According to the McKinsey report, as much as 3.5-6 per cent of GDP will be required. Under the current Line of Sight scenario, $7.2 trillion in green investments are required in the years leading up to 2050. An additional $4.9 trillion would be required in an accelerated scenario.

In comparison, Indian climate tech companies received only $1 billion in venture capital funding between 2016 (when the Paris Agreement was signed) and 2021, according to a report by London & Partners and Dealroom.co. Ad hoc investments by impact funds, global foundations, and generalist VC firms account for the majority of climate tech investments in India.

The growing concern about climate change and its impact on society has spurred a new investment discourse. In the past, firms have done little or nothing to maintain the environment and promote social cohesion and diversity, but with increased demand from regulatory agencies and other public watchers, investors have started incorporating concerns about these issues.

Denne historien er fra December 31, 2022-utgaven av Businessworld India.

Start din 7-dagers gratis prøveperiode på Magzter GOLD for å få tilgang til tusenvis av utvalgte premiumhistorier og 9000+ magasiner og aviser.

Allerede abonnent ? Logg på

Denne historien er fra December 31, 2022-utgaven av Businessworld India.

Start din 7-dagers gratis prøveperiode på Magzter GOLD for å få tilgang til tusenvis av utvalgte premiumhistorier og 9000+ magasiner og aviser.

Allerede abonnent? Logg på

Technology, AI Driving Warehousing Sustainability

Anshul Singhal on how Welspun One is rapidly transforming Grade-A logistics and industrial parks across India, offering integrated fund development and asset management for large-scale warehousing solutions

DECODING RETAIL'S NEXT FRONTIER

As brands pivot towards omnichannel ecosystems and startups challenge legacy frameworks, the focus sharpens on experiential retail, sustainability and data-driven personalisation.

SORORITY OF WOMEN OF METTLE

Awinter afternoon in mid-December found quite a crowd at the Oxford Book Store on Connaught Place, as bibliophiles congregated at a corner to listen to three women authors, diverse in their passions, but drawn together by an urge to tell their story.

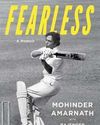

THE LEGACY OF THE AMARNATHS

IN NOVEMBER 2017 the management committee of the Delhi Cricket Association named the eastern stand of the Feroze Shah Kotla ground the Mohinder Amarnath stand.

PUTTING THE POWER IN THE POWERHOUSE

The Asus ExpertBook P5 is powered by an 8-core 8-thread Intel Core Ultra 7 Series 2 processor that clocks a maximum speed of 4.8 GHz, but it does not have hyperthreading. It is light weight, with a smooth glass touch pad. The laptop almost has all the I/O ports you could possibly need in a business laptop, making it an extremely lucrative option for professional computing, says

"We must be aware of our energy and water consumption"

BW Businessworld caught up with actor, philanthropist, and climate warrior BHUMI PEDNEKAR to chat about climate change and more.

"Cooking is a passport to the world"

In conversation with renowned CHEF MANJIT GILL, Advisor at Kikkoman India and President, Indian Federation of Culinary Associations (IFCA). As the former Corporate Chef of ITC hotels, Chef Gill has helped shape iconic restaurants, such as the Bukhara, Dum Pukht, and Dakshin. He has had the privilege of serving former American Presidents Barack Obama, Bill Clinton, George Bush, and the French, Canadian, British and German premiers. In 1992, Chef Gill had the opportunity of being invited to cook for Prince Charles and Lady Diana, at the Palace of the Maharaja of Jaipur. He was awarded the Lifetime Achievement Award from the Ministry of Tourism in 2007.

Strengthening Middle Management for Organisational Resilience

WHAT HOLDS AN organisation together in chaos? Is it visionary leadership, cuttingedge strategies, or robust technology?

The Retail Trailblazers

A look at companies that are making a positive impact on India's growing retail sector with their future fit business and marketing strategies.

Driving Conscious Consumerism

VIDIT JAIN, Co-founder of Kindlife, is leading the charge in revolutionising the intersection of technology and conscious consumerism.