THE STARTUP ECOSYSTEM is witnessing an uptick in mergers and acquisitions after a surge in large-scale exits through initial public offerings (IPOs). The funding crunch being experienced by the startup community coincides with the economic slowdown and uncertainty that most economies are going through now. The mood within the venture capital (VC) and private equity (PE) fraternity is conservative.

Will home-grown Indian VCs be able to step up and fill the void of flight of capital toward a stronger reserve currency, the dollar? Home market players feel they do not have parity with international capital because approvals are comparatively slow, capital raising is highly challenging and higher constraints on overseas investments. While the overall sentiment remains positive, monetary policy tightening continues to remain a sensitive point affecting capital flows into India. According to a latest PwC report, the total funding in Indian startups dropped by 60 per cent in the second quarter of the 2021-2022 financial year (Q2 FY 2022). A number of startups such as Ola, Snapdeal and Pharmacy have delayed their IPOs because of the "funding winter".

A new crop of domestic investors are, however, on the prowl. These are India-focused investors and specialised theme-run funds. "We can't be competitive as a domestic VC industry unless we can avail of the same benefits in our home market as international investors can. It's far easier today to be an FDI investor than a domestic investor. We should ensure that this becomes a level playing field as well," says Karthik Reddy, Chairperson of the Executive Committee of the Indian Venture and Alternate Capital Association (IVCA).

Denne historien er fra 30 July 2022-utgaven av Businessworld India.

Start din 7-dagers gratis prøveperiode på Magzter GOLD for å få tilgang til tusenvis av utvalgte premiumhistorier og 9000+ magasiner og aviser.

Allerede abonnent ? Logg på

Denne historien er fra 30 July 2022-utgaven av Businessworld India.

Start din 7-dagers gratis prøveperiode på Magzter GOLD for å få tilgang til tusenvis av utvalgte premiumhistorier og 9000+ magasiner og aviser.

Allerede abonnent? Logg på

Technology, AI Driving Warehousing Sustainability

Anshul Singhal on how Welspun One is rapidly transforming Grade-A logistics and industrial parks across India, offering integrated fund development and asset management for large-scale warehousing solutions

DECODING RETAIL'S NEXT FRONTIER

As brands pivot towards omnichannel ecosystems and startups challenge legacy frameworks, the focus sharpens on experiential retail, sustainability and data-driven personalisation.

SORORITY OF WOMEN OF METTLE

Awinter afternoon in mid-December found quite a crowd at the Oxford Book Store on Connaught Place, as bibliophiles congregated at a corner to listen to three women authors, diverse in their passions, but drawn together by an urge to tell their story.

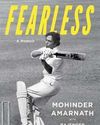

THE LEGACY OF THE AMARNATHS

IN NOVEMBER 2017 the management committee of the Delhi Cricket Association named the eastern stand of the Feroze Shah Kotla ground the Mohinder Amarnath stand.

PUTTING THE POWER IN THE POWERHOUSE

The Asus ExpertBook P5 is powered by an 8-core 8-thread Intel Core Ultra 7 Series 2 processor that clocks a maximum speed of 4.8 GHz, but it does not have hyperthreading. It is light weight, with a smooth glass touch pad. The laptop almost has all the I/O ports you could possibly need in a business laptop, making it an extremely lucrative option for professional computing, says

"We must be aware of our energy and water consumption"

BW Businessworld caught up with actor, philanthropist, and climate warrior BHUMI PEDNEKAR to chat about climate change and more.

"Cooking is a passport to the world"

In conversation with renowned CHEF MANJIT GILL, Advisor at Kikkoman India and President, Indian Federation of Culinary Associations (IFCA). As the former Corporate Chef of ITC hotels, Chef Gill has helped shape iconic restaurants, such as the Bukhara, Dum Pukht, and Dakshin. He has had the privilege of serving former American Presidents Barack Obama, Bill Clinton, George Bush, and the French, Canadian, British and German premiers. In 1992, Chef Gill had the opportunity of being invited to cook for Prince Charles and Lady Diana, at the Palace of the Maharaja of Jaipur. He was awarded the Lifetime Achievement Award from the Ministry of Tourism in 2007.

Strengthening Middle Management for Organisational Resilience

WHAT HOLDS AN organisation together in chaos? Is it visionary leadership, cuttingedge strategies, or robust technology?

The Retail Trailblazers

A look at companies that are making a positive impact on India's growing retail sector with their future fit business and marketing strategies.

Driving Conscious Consumerism

VIDIT JAIN, Co-founder of Kindlife, is leading the charge in revolutionising the intersection of technology and conscious consumerism.