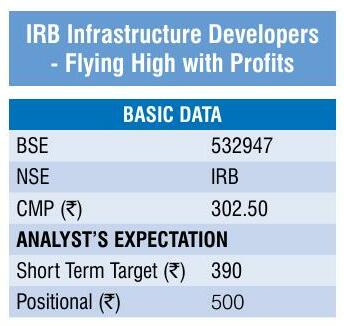

The Board of Directors of India's first integrated multi-national highway infrastructure developer, IRB Infrastructure Developers Limited has today approved the split/sub-division of existing share with face value of 10/- per share in 0 shares with face value of 1 per share. The stock has gone through a wonderful journey from around 55 to 290 levels in three years, giving a return of 450 per cent in this time horizon. The company will now initiate for shareholders' approval and regulatory nods. The company said that it is done with the aim to enhance the liquidity in the capital market, to widen shareholder base. and to make the shares more affordable to small investors. The record date will be announced later, however it will be completed by 28 February, 2023.

Recent Development

Denne historien er fra January 2023-utgaven av Indian Economy & Market.

Start din 7-dagers gratis prøveperiode på Magzter GOLD for å få tilgang til tusenvis av utvalgte premiumhistorier og 9000+ magasiner og aviser.

Allerede abonnent ? Logg på

Denne historien er fra January 2023-utgaven av Indian Economy & Market.

Start din 7-dagers gratis prøveperiode på Magzter GOLD for å få tilgang til tusenvis av utvalgte premiumhistorier og 9000+ magasiner og aviser.

Allerede abonnent? Logg på

Globalism, Freedom & Democracy Do Not Mix

The world today is packed with wealthy institutions and individuals that stand in revolt against the ideas of freedom and democracy. They do not like the idea of geographically constrained states with zones of juridical power.

WORLD DEVELOPMENT REPORT 2024 THE MIDDLE-INCOME TRAP

A World Bank report titled 'World Development Report 2024: The Middle-Income Trap' indicates that India may take up to 75 years to attain just a quarter of the United States' per capita income. The insights in the report provides a useful reality check for India's ambitious goals, such as becoming a developed economy by 2047 or reaching a $5 trillion economy within the next three years.

IN CONVERSATION: "We are working with a Vision 2035. I'm sure within next 5 years we will be ranking among the Fortune 500 companies.”

Sudarshan Pharma Industries Ltd., led by its promoters, Mr. Hemal V. Mehta, a chemical engineer, and Mr. Sachin V. Mehta, has established a strong foundation in specialty chemicals and bulk drugs. Their relentless enthusiasm is visible when they speak. Indian Economy & Market reached out, to piece together the company's achievements and new initiatives in detail.

Sudarshan Pharma Industries Ltd. A MULTIBAGGER IN MAKING

Sudarshan Pharma Industries Ltd. operates across various sectors in both the pharmaceutical and chemical industries, with a focus on specialty chemicals and intermediates, which find applications in Indian Le pharmaceuticals, paints, food products, and adhesives.

MUTUAL FUND LITE OR MF LIT PROMISING PROGRESS FOR INVESTORS

The SEBI has streamlined rules for passively managed schemes to have the impact of letting more players in the mutual fund ecosystem and offering diversified, low-risk investment options to retail investors. It would increase market liquidity and attract participation from old as well as new Asset Management Companies (AMCs). Shivanand Pandit feels that MF Lite is going to democratize investment opportunities in the Indian financial market.

BRICS Member States Ready to Dethrone Dollar

AS the US weaponises the dollar in the Russian and Iranian sanctions, there is increasing desire by other developing countries to seek alternative currencies for trade, investment, and reserves, as well as developing alternative multilateral clearance systems outside of SWIFT.

7 BEST PHARMA COMPANIES

The pharmaceutical industry in India is expected to reach $65 Bn by end of 2024 and to $130 Bn by 2030. India is a major exporter of Pharmaceuticals, with over 200+ countries served by Indian pharma exports. While Nifty's performance has been lackluster over the past month, several pharmaceutical stocks have shown resilience.

NEW INVESTMENT PRODUCT CATEGORY IS SEBI'S LATEST MOVE COMMENDABLE?

The Securities and Exchange Board of India (SEBI) has introduced a consultation paper proposing a new investment product category aimed at addressing a specific market need. This proposed asset class would offer investment options that sit between mutual funds (MFS) and PMS, filling a gap and providing greater flexibility in portfolio management. The new investment vehicle is designed for investors who are prepared to take on riskier market positions but find PMS schemes or AIFs out of reach. SEBI after reviewing the feedback and finalizing the regulations through stakeholder discussions, may issue the final regulations.

DECODING THE CHINA MYTH

Myths die hard. Among these is the great myth that China's poised to take over the world. Here, James Rickards debunks that myth.

What Is In Store For The Indian Economy?

Until the 2014 Lok Sabha elections, when the Bharatiya Janata Party secured 282 seats and Narendra Modi ascended to power, India experienced 21 years of coalition governments. A decade later, the BJP holds 240 seats in the Lok Sabha, and India is once again governed by a coalition. Fitch has indicated that coalition politics and a weakened mandate for the NDA could hinder the passage of ambitious reform legislation. It raises the question: Do coalition governments impede the economic reform agenda?