As the July-September quarter of 2024-25 (FY25) comes to an end amid intense debate over whether the best is behind India's banking industry, let's look closely at some critical data.

The industry's year-on-year (Y-o-Y) operating profit—or the operating profit of the September quarter of the current financial year (FY25) over the September quarter of the previous finance year (FY24)—is up by a handsome 20.27 per cent, from ₹1.27 trillion to ₹1.52 trillion (figures are rounded off).

Besides all universal banks, this includes the earnings of nine small finance banks (SFBs).

The State Bank of India (SBI) leads the brigade with a 51 per cent increase in its operating profit, from ₹19,417 crore to ₹29,294 crore.

Among others, IDBI Bank Ltd has posted 45.12 per cent growth in operating profit and Central Bank of India, 41.46 per cent.

Only two universal banks have shown a drop in Y-o-Y operating profit—IndusInd Bank Ltd and Karnataka Bank Ltd. On a quarter-on-quarter (Q-o-Q) basis, or the September quarter over the June quarter of FY25, besides these two, at least five other banks have recorded a decline.

After making provisions, the industry's net profit is up 18.61 per cent (₹91,792 crore).

In absolute terms, SBI tops the list with a ₹18,331 crore net profit, followed by HDFC Bank Ltd (₹16,821 crore).

SBI's net profit is up 27.92 per cent and that of HDFC Bank, 5.29 per cent.

Three private banks—IndusInd Bank, IDFC First Bank Ltd, and RBL Bank Ltd—have recorded a dip in their net profits.

Overall, the provisions made by them are up 26.68 per cent, but eight private banks and seven public sector banks have cut down on their provisions.

Net interest income (NII) is the main driver of the banks' profit.

This is up 8.99 per cent Y-o-Y, though only 1.05 per cent Q-o-Q.

Two banks have posted a drop in their NII Y-o-Y, and seven Q-o-Q.

This story is from the November 18, 2024 edition of Business Standard.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber ? Sign In

This story is from the November 18, 2024 edition of Business Standard.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber? Sign In

CRYING OVER SPILT MILK

From 6.62 in FY18, India’s milk production growth rate has fallen sharply to 3.78% in FY24

The art of leaving

Ravichandran Ashwin, the quintessential cricketing nerd who bamboozled batters through skill, guile, and acumen, stumped fans around the globe on Wednesday when he retired from international cricket with immediate effect at the end of the third Test of the Border-Gavaskar Trophy in Brisbane.

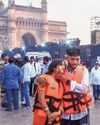

13 dead as Navy speedboat rams into ferry off Mumbai coast

Thirteen persons died and 99 others were rescued after a Navy craft crashed into a ferry off the Mumbai coast on Wednesday, the Navy said.

How senior living market is redefining retirement

With a growing population of India's well-to-do elderly choosing to live well and live free, businesses have spotted an opportunity. The first of a four-part series on the silver economy focuses on luxury housing projects developed with seniors in mind

TRAVEL INSURANCE FOR HOLIDAYERS Sum insured should depend on destination, trip duration, and age

This holiday season, Indian travellers are likely to flock to short-haul destinations.

New coat of opportunity for Berger and Indigo

Analysts see potential in select paint stocks amid entry of big players

Aluminium seen as outlier among metals; Hindalco better placed

Most industrial metals are expected to stay bearish at least in early 2025. However, aluminium could be an exception.

₹ hits fresh low of 84.96 against $

The rupee has depreciated further to close at a fresh low of 84.96 against the US dollar on Wednesday as foreign banks purchased dollars on behalf of their clients ahead of the outcome of the US Federal Reserve meeting, said dealers.

FPI selling ahead of Fed meet drags market down for 3rd day

Overseas investors pull out ₹8,000 crore this week

Bourses see three blockbuster debuts

Mobikwik up 90%; Vishal Mega Mart, Sai Life gain 40%