BACK IN LATE APRIL, a week after last year’s taxes were due to Uncle Sam, Talor Gooch won a LIV Golf event in Adelaide, Australia. His post-victory comments on a golf podcast made as much news as the victory itself. “I am by no means complaining,” Gooch said, merely noting that “it sucked that 47 and a half percent” of his $4 million top prize was withheld for Australian taxes, so “once you cut it all up, let’s just say that it’s a lot less than four.” It was, the Midwest City, Okla., native said, “a little bit disheartening.”

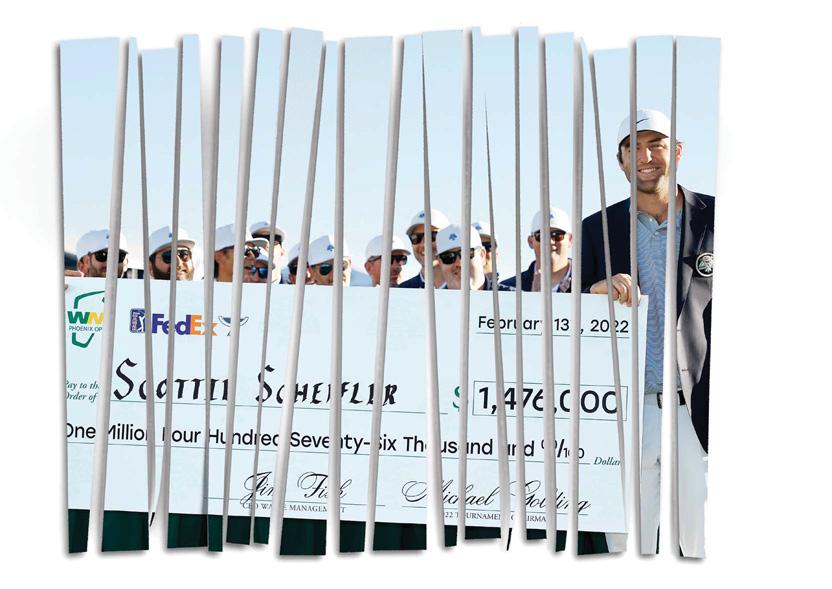

Whether one saw this as the second coming of Marie Antoinette’s infamous “Let them eat cake” or an all-too-relatable lament of workers everywhere, it brought to the fore a question every golf fan has had watching an oversize check being hoisted aloft: How much does the winner actually take home? Trophies and record books are great, but what’s the bottom line?

Gooch will have known from his prior stint on the PGA Tour, where he won the 2021 RSM Classic, that taxes aren’t just the price we pay for a civilized society (per Oliver Wendall Holmes Jr.). They’re par for the course on any circuit for winners and for the vanquished (except for the missed-cutters who make bubkes for the week… something Gooch needn’t worry about anymore on the no-cut LIV—nor competitors in eight designated no-cut, limited-field, “elevated” PGA Tour events, too, starting in 2024).

This story is from the July - August 2023 edition of Golf US.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber ? Sign In

This story is from the July - August 2023 edition of Golf US.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber? Sign In