Income tax rarely finds a voice in public debate or discussions. Perhaps the only day, when income tax finds itself being discussed extensively, is on the day of the Union Budget when one anticipates announcements regarding changes in taxation. Earlier this year, during her Budget speech, Minister of Finance Nirmala Sitharaman announced changes in direct tax rates as well as rules which brought mixed reactions among the under seven crore individual income taxpayers. She also stated that the new tax regime would be the default option from April 1, 2023.

The new tax regime was introduced in the financial year 2020-21 for individual taxpayers and Hindu Undivided Families (HUF). However, it did not find that many takers and the fact that the old tax regime looked favourable despite the three slabs it offered compared to seven slabs under the new regime. A significant sweetener on offer this year in the new tax regime is the tax rebate on taxable income up to Rs 7 lakh and a standard deduction of Rs 50,000. So, anyone with a gross income of Rs 7.5 lakh would pay no tax.

In the old tax regime, gross total income up to Rs 7 lakh resulted in no tax if one claimed tax deductions up to Rs 1.5 lakh along with the standard deduction of Rs 50,000. With tax payers used to the format of the old tax regime and it being the default option, very few taxpayers opted for the new regime. The big difference between the old and new regimes is the choice of claiming deductions and exemptions in the old regime versus the lack of it in the new regime.

Bu hikaye India Today dergisinin July 31, 2023 sayısından alınmıştır.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber ? Giriş Yap

Bu hikaye India Today dergisinin July 31, 2023 sayısından alınmıştır.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber? Giriş Yap

Delhi's Belly

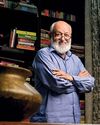

Academic, historian and one of India's most-loved food writers, PUSHPESH PANT'S latest book-From the King's Table to Street Food: A Food History of Delhi-delves deep into the capital's culinary heritage

IT TAKES TWO TO TANGO

Hemant and Kalpana Soren changed Jharkhand's political game, converting near-collapse into an extraordinary comeback

THE MAHA BONDING

At one time, Fadnavis, Shinde and Ajit Pawar were seen as an unwieldy trio with mutually subversive intent. A bumper assembly poll harvest inverts that

THE LION PRINCE

A spectacular assembly election win ended a long political winter for Kashmir and his party, the National Conference. But Omar Abdullah now faces crucial tests—that of meeting great expectations and holding his own with the Centre till J&K gets its statehood back

TRIAL BY FIRE

Formal charges in a US court, an air marked by accusations of bribery and concealment of information, the attendant political backlash, pressure on stock prices, valuation losses. Yet the famed Adani growth appetite and business resilience stays

'Criticism has always been a source of motivation for me'

It’s just day five since he was crowned 2024 FIDE World Chess champion (which he celebrated with a bungee jump), and Gukesh Dommaraju is still learning to adjust to the fanfare.

THE YOUNG GRANDMASTERS

GUKESH DOMMARAJU IS NOW THE YOUNGEST EVER WORLD CHAMPION, BUT THAT IS JUST ICING ON THE CAKE IN INDIA'S CHESS STORY. FOR THE 'GOLDEN GENERATION', 2024 WAS THE YEAR THEY DID IT ALL

SHOOTING QUEEN

Manu Bhaker scripted a classic turnaround at Paris 2024, putting the ghosts of the past behind her through sheer willpower to engrave her own destiny

THE COMEBACK KING

It was in no one's script: Naidu's standing leap from near-oblivion, to a place where he writes the destiny of Andhra—even New Delhi

HALTING THE BJP JUGGERNAUT

A roller-coaster year saw the Opposition coalition rebound with bold moves and policy wins, but internal rifts continue to test its durability