FEBRUARY 24, 2021. Speaking at a webinar on privatisation by the Department of Investment and Public Asset Management (DIPAM), Prime Minister Narendra Modi declared that the government has no business to be in business and his administration was committed to privatising all PSUs barring the bare minimum in four strategic sectors. “It is government’s duty to support enterprises and businesses. But it is not essential that it should own and run enterprises,” he said.

Adding that fiscal support to sick and loss-making PSUs using taxpayers’ money puts burden on the economy, the Prime Minister said there many underutilised and untilised assets in the public sector and 100 of these would be monetised to garner Rs 2.5 lakh crore.

He was speaking a few weeks after the budget, and, perhaps trying to justify the sale of public assets so far. For two consecutive years—FY18 and FY19—the government raised nearly Rs 2 lakh crore from disinvestment against a stated target of Rs 1.53 lakh crore. Then things changed. The global pandemic came amid already sluggish economic conditions of FY20. And then came the Russia-Ukraine conflict.

Lower Targets

Fast forward to Budget 2023-24. For the fourth year in a row the central government has failed to meet its own disinvestment targets. This time, the finance minister refrained from spelling out any targets for FY24. For FY23, the government managed to collect only Rs 31,100 crore through minority stake sale in state-owned PSUs, out of the Rs 65,000 crore disinvestment target kept for this fiscal. Therefore, for 2023-24, the budget has pegged disinvestment revenue at Rs 51,000 crore against Rs 65,000 crore announced for FY23.

Bu hikaye Business World India dergisinin February 25, 2023 sayısından alınmıştır.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber ? Giriş Yap

Bu hikaye Business World India dergisinin February 25, 2023 sayısından alınmıştır.

Start your 7-day Magzter GOLD free trial to access thousands of curated premium stories, and 9,000+ magazines and newspapers.

Already a subscriber? Giriş Yap

Technology, AI Driving Warehousing Sustainability

Anshul Singhal on how Welspun One is rapidly transforming Grade-A logistics and industrial parks across India, offering integrated fund development and asset management for large-scale warehousing solutions

DECODING RETAIL'S NEXT FRONTIER

As brands pivot towards omnichannel ecosystems and startups challenge legacy frameworks, the focus sharpens on experiential retail, sustainability and data-driven personalisation.

SORORITY OF WOMEN OF METTLE

Awinter afternoon in mid-December found quite a crowd at the Oxford Book Store on Connaught Place, as bibliophiles congregated at a corner to listen to three women authors, diverse in their passions, but drawn together by an urge to tell their story.

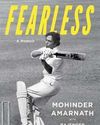

THE LEGACY OF THE AMARNATHS

IN NOVEMBER 2017 the management committee of the Delhi Cricket Association named the eastern stand of the Feroze Shah Kotla ground the Mohinder Amarnath stand.

PUTTING THE POWER IN THE POWERHOUSE

The Asus ExpertBook P5 is powered by an 8-core 8-thread Intel Core Ultra 7 Series 2 processor that clocks a maximum speed of 4.8 GHz, but it does not have hyperthreading. It is light weight, with a smooth glass touch pad. The laptop almost has all the I/O ports you could possibly need in a business laptop, making it an extremely lucrative option for professional computing, says

"We must be aware of our energy and water consumption"

BW Businessworld caught up with actor, philanthropist, and climate warrior BHUMI PEDNEKAR to chat about climate change and more.

"Cooking is a passport to the world"

In conversation with renowned CHEF MANJIT GILL, Advisor at Kikkoman India and President, Indian Federation of Culinary Associations (IFCA). As the former Corporate Chef of ITC hotels, Chef Gill has helped shape iconic restaurants, such as the Bukhara, Dum Pukht, and Dakshin. He has had the privilege of serving former American Presidents Barack Obama, Bill Clinton, George Bush, and the French, Canadian, British and German premiers. In 1992, Chef Gill had the opportunity of being invited to cook for Prince Charles and Lady Diana, at the Palace of the Maharaja of Jaipur. He was awarded the Lifetime Achievement Award from the Ministry of Tourism in 2007.

Strengthening Middle Management for Organisational Resilience

WHAT HOLDS AN organisation together in chaos? Is it visionary leadership, cuttingedge strategies, or robust technology?

The Retail Trailblazers

A look at companies that are making a positive impact on India's growing retail sector with their future fit business and marketing strategies.

Driving Conscious Consumerism

VIDIT JAIN, Co-founder of Kindlife, is leading the charge in revolutionising the intersection of technology and conscious consumerism.