Mid negotiations and renegotiations of a flurry of free trade agreements (FTAs), India is contemplating an FTA negotiating strategy.

Discussions to roll out a standard operating procedure (SOP) for FTA negotiations first started more than a decade ago, after India signed pacts with its key neighboring countries and was also in discussions with some developed nations to strike similar deals.

It was felt that an SOP would act like a guidance document and help in creating an institutional memory for future negotiations.

Though bureaucrats at the department of commerce held intense discussions over the next three-four years, the SOP did not see the light of the day, mainly due to lack of internal consensus.

The idea has now been revived, against the backdrop of India signing four trade pacts within a span of three years—between 2021 and 2024—with Mauritius, United Arab Emirates (UAE), Australia, and European Free Trade Association (EFTA).

India has been in discussions with at least half a dozen countries for trade and investment pacts.

That apart, there is growing importance of sustainability and issues such as government procurement, labor, and digital trade being a part of modern trade deals.

Government officials believe the need for a negotiating strategy for FTAs is crucial, considering India's past experience with South Korea and the Association of South East Asian Nations (ASEAN), where, several government officials believe India has not been a net gainer.

In fact, they say, even the recently signed trade deal with the UAE has not resulted in large gains for India.

In all these cases, India's trade deficits with these countries have widened after signing the pact, along with other challenges such as non-tariff barriers.

India also needs to be wary of the rising imports from China and whether FTAs signed by India are being used to route goods from China to India, the officials say.

Diese Geschichte stammt aus der November 15, 2024-Ausgabe von Business Standard.

Starten Sie Ihre 7-tägige kostenlose Testversion von Magzter GOLD, um auf Tausende kuratierte Premium-Storys sowie über 8.000 Zeitschriften und Zeitungen zuzugreifen.

Bereits Abonnent ? Anmelden

Diese Geschichte stammt aus der November 15, 2024-Ausgabe von Business Standard.

Starten Sie Ihre 7-tägige kostenlose Testversion von Magzter GOLD, um auf Tausende kuratierte Premium-Storys sowie über 8.000 Zeitschriften und Zeitungen zuzugreifen.

Bereits Abonnent? Anmelden

CRYING OVER SPILT MILK

From 6.62 in FY18, India’s milk production growth rate has fallen sharply to 3.78% in FY24

The art of leaving

Ravichandran Ashwin, the quintessential cricketing nerd who bamboozled batters through skill, guile, and acumen, stumped fans around the globe on Wednesday when he retired from international cricket with immediate effect at the end of the third Test of the Border-Gavaskar Trophy in Brisbane.

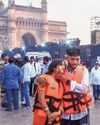

13 dead as Navy speedboat rams into ferry off Mumbai coast

Thirteen persons died and 99 others were rescued after a Navy craft crashed into a ferry off the Mumbai coast on Wednesday, the Navy said.

How senior living market is redefining retirement

With a growing population of India's well-to-do elderly choosing to live well and live free, businesses have spotted an opportunity. The first of a four-part series on the silver economy focuses on luxury housing projects developed with seniors in mind

TRAVEL INSURANCE FOR HOLIDAYERS Sum insured should depend on destination, trip duration, and age

This holiday season, Indian travellers are likely to flock to short-haul destinations.

New coat of opportunity for Berger and Indigo

Analysts see potential in select paint stocks amid entry of big players

Aluminium seen as outlier among metals; Hindalco better placed

Most industrial metals are expected to stay bearish at least in early 2025. However, aluminium could be an exception.

₹ hits fresh low of 84.96 against $

The rupee has depreciated further to close at a fresh low of 84.96 against the US dollar on Wednesday as foreign banks purchased dollars on behalf of their clients ahead of the outcome of the US Federal Reserve meeting, said dealers.

FPI selling ahead of Fed meet drags market down for 3rd day

Overseas investors pull out ₹8,000 crore this week

Bourses see three blockbuster debuts

Mobikwik up 90%; Vishal Mega Mart, Sai Life gain 40%