Versuchen GOLD - Frei

‘Ready to export to new EV mkts if there is demand’

Business Standard

|October 10, 2024

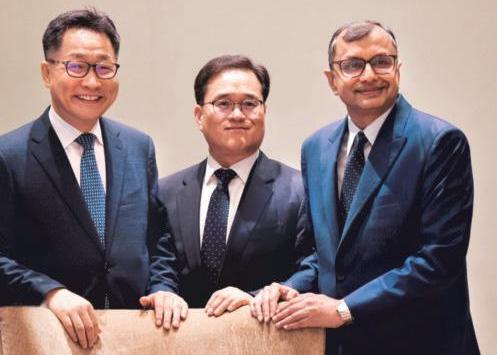

All set to debut on Indian bourses, Korean-origin auto major Hyundai Motor India Ltd (HMIL) says its IPO will ensure the company is more “dedicated” to succeed in India. Speaking with Sohini Das and Samie Modak in Mumbai, UNSOO KIM, president, CEO and MD, WANGDO HUR, executive director and CFO, and TARUN GARG, whole time director and COO of HMIL outline their plans. Edited excerpts:

Why is Hyundai Motor looking to list in India?

Kim: This is one of the most fundamental questions and very crucial to us. India is one of the most exciting automobile markets in the world and Hyundai Motor India has been successful for 26 years, and currently we are the second-largest passenger vehicle maker in India. Therefore, we feel it is the right time to further "Indianise" our operations here and become a "home-brand" in India.

Our IPO will ensure that HMIL is even more dedicated to succeed in India. Also, we continue to pursue global standards in terms of governance. The IPO will provide a good opportunity for local and global investors to take part in our growth story.

When did the idea of doing an India IPO come?

Kim: Globally, Hyundai Motor Group (HMG) is the third-largest, and Hyundai Motor Corporation (HMC) has great business capabilities worldwide - R&D capability, brand power, and best practices. HMC's vision is to transport humanity and under that vision we started our operations in India in 1998. It is the right time now to go for an IPO.

What is the investor feedback on your valuation?

Diese Geschichte stammt aus der October 10, 2024-Ausgabe von Business Standard.

Abonnieren Sie Magzter GOLD, um auf Tausende kuratierter Premium-Geschichten und über 9.000 Zeitschriften und Zeitungen zuzugreifen.

Sie sind bereits Abonnent? Anmelden

WEITERE GESCHICHTEN VON Business Standard

Business Standard

Competitive challenges to keep Eternal under pressure

The Q3FY26 results from Eternal contained two major surprises.

3 mins

January 23, 2026

Business Standard

Zeel net profit down 5%

Zee Entertainment Enterprises (Zeel) on Thursday reported as.1 per cent fall in its consolidated net profit to ₹155.3 crore in the third quarter of the financial year 2026 (Q3FY26) against the same period last year.

1 min

January 23, 2026

Business Standard

Add planes to claim slots vacated by IndiGo: Centre to airlines

The vacated slots should not remain unutilised, says the Centre

1 mins

January 23, 2026

Business Standard

Air India braces for record $1.6 bn loss in FY26

Air India is set to report a record annual loss after last year’s deadly crash and airspace shutdowns wiped out progress toward a turnaround, according to people familiar with the matter.

1 min

January 23, 2026

Business Standard

DLF posts 13.6% profit on high net income

Report card DLF consolidated figures in ₹ cr

1 min

January 23, 2026

Business Standard

Republic Day weekend sets travel wheels spinning

Surge towards nearby getaways and quick overseas hops

2 mins

January 23, 2026

Business Standard

Industry seeks Customs SVB scrapping

Ahead of the Union Budget 2026-27, industry has demanded the scrapping of Customs Special Valuation Branch (SVB), a specialised unit that examines whether prices of imports between related parties, such as an Indian subsidiary and its foreign parent, have been influenced by their relationship.

1 mins

January 23, 2026

Business Standard

Non-US uptick seen driving gains for Dr Reddy’s Labs

Brokerages bullish on company despite Q3FY26 margin pressure

2 mins

January 23, 2026

Business Standard

Govt may use digital farmer IDs to rationalise urea sales

Move could be another attempt to rein in burgeoning fertiliser subsidy

2 mins

January 23, 2026

Business Standard

Silicon Valley pours out lobbying, cash & flattery to win over Trump

Government relations shops for Nvidia Corp, OpenAl Inc, Meta Platforms Inc and other firms expanded and rebranded in 2025 to better align with the president.

1 min

January 23, 2026

Listen

Translate

Change font size