CATEGORIES

Categorías

Ukrainian Ex-POWs Survived Torture at Hands of Russians

Twenty-six Ukrainian prisoners of war sat naked on a cold stone floor, their legs crossed, heads bowed and hands clasped behind their backs.

NOW YOU SEE HER

Bertha Russell would be so disappointed. When Carrie Coon, who plays the calculating social climber on The Gilded Age, sits down at the Regency Bar & Grill, just a few blocks and about 140 years from the fictional mansion where her character resides, it's the tail end of the restaurant's infamous power breakfast—a crucial error in timing for anyone hoping to rub elbows with New York City's ruling class.

Musk Criticizes AI Project Backed By Trump

President's close ally raises questions on funding, spars online with OpenAI chief

The Secret Service and the President's Life

The week Donald Trump won re-election, the Justice Department warned about continued assassination plots against elected officials, this time from Iran.

Rising Corn Prices Offer Growers Hope

However, Trump's tariffs could quickly halt gains and demand for the grain

Netflix Explodes Into a New Era

Streamer unveils blowout subscriber numbers and price increase, but record value sets a high bar

Children Who Need Parents

The Sun Won't Come Out Tomorrow

The Most Valuable Program In College Football Is Ohio State

OHIO STATE just won the right to call itself college football's national champions by stomping Notre Dame. But even before they took down the Fighting Irish, the Buckeyes had already earned an even more lucrative title.

Meme Coins Like Trump's Stir Wild Market

Just days ahead of his return to the White House, President Trump and his wife, Melania, launched a pair of meme coins that have skyrocketed in value and earned them billions of dollars, at least on paper.

Prince Harry Settles U.K. Tabloid Suit

Murdoch's papers apologize for privacy intrusions on Duke and Princess Diana

WHERE THE WILDLY EXPENSIVE THINGS ARE

In a small city in the Dutch hinterlands, sharp-elbowed dealers hunt the biggest game of all: billionaire collectors voracious for treasures from the last art fair that truly matters.

Drug Violence Surges in Colombia

The war over cocaine between armed groups in northeastern Colombia has killed about 80 people in recent days and forced tens of thousands to flee their homes, signaling a likely end to President Gustavo Petro's plans to sign peace accords with drug-trafficking groups.

Not Just Homes, but Also Many Workplaces, Have Vanished

LOS ANGELES-Antonieta Lopez knew each feature and quirk of the stately, East Coast-style home on Villa View Drive.

New Wildfire Spreads Quickly In L.A. County

Hughes fire scorches thousands of acres north of Santa Clarita, forces evacuations

How Young Is Too Young to Start an Art Collection?

It will take more than just a trust fund to get them to sell you that painting.

Baby-Boomer Women Power Wealth Transfer

They now have the final say on how family nest eggs get parceled out

Give Me Liberty!

Creative freedom, it turns out, is a very wise investment.

President Begins to Dismantle And Reshape Federal Workforce

President Trump's pledge to upend the federal workforce began rippling through Washington after he moved to force government employees back to the office five days a week, weakened their job protections and froze diversity efforts across the government.

READ THE FINE PRINT

Nestled among the winding, narrow streets of Berkeley, California, which curve past a pastiche of architectural styles, including the material opulence of the spare modern mansions belonging to the tech elite, Susan Filter and Peter Koch's home stands apart.

The ROTHSCHILD and the SNOWSTORM

Four decades after Jeannette May's remains were found on an Italian mountainside, the authorities have reopened the investigation into who or what-killed the former Lady de Rothschild.Was it a kidnapping? A mafia hit? Or have the rumors been wrong all along?

THE MASTER BUILDER

For the collector and philanthropist Amalia Amoedo, living with art and supporting the people who make it isn't just a choice it's a tradition. Is it any wonder she's known as Latin America's Peggy Guggenheim?

Davos Dissects Risks, Rewards of Trump

Bankers, government officials see benefits tilting toward U.S, away from Europe

A Passion for Patterns

An exhibition highlights the fragile beauty and striking designs of centuries-old wallpaper

Shares of U.K.'s easyJet Slide As Carrier Warns on Quarter

Budget airline flags weakening revenue trends, sending the stock 5.2% lower

The Best and Worst Airlines of 2024

How Delta and Southwest separated themselves from the pack in a near photo finish

Electronic Arts Lowers Its Outlook

Electronic Arts cut its outlook, citing less engagement across its soccer-themed videogame titles.

Cheap Canada Oil That U.S. Craves Is Now at Risk

The cheap Canadian oil America craves is becoming a key bargaining chip in President Trump's threatened trade war.

Five Things to Know About The Latest Orders on Energy

President Trump signed a salvo of executive actions this week aimed at unleashing America's energy resources and fulfilling his campaign promise to make oil and gas a pillar of U.S. prosperity and global dominance.

The Star Being Kept Out of Cooperstown

Ichiro Suzuki, CC Sabathia and Billy Wagner were voted into baseball's Hall of Fame, while Carlos Beltrán fell short again after his role in the 2017 Houston Astros sign-stealing scandal

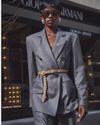

The WIZARD of MADISON

Suit up before stepping inside Giorgio Armani's new uptown Oz.