Intentar ORO - Gratis

How To Teach Money Concepts To Children

Outlook Money

|December 2023

In a recent webinar, experts said having conversations and applying innovative ways can help teach children about money concepts

-

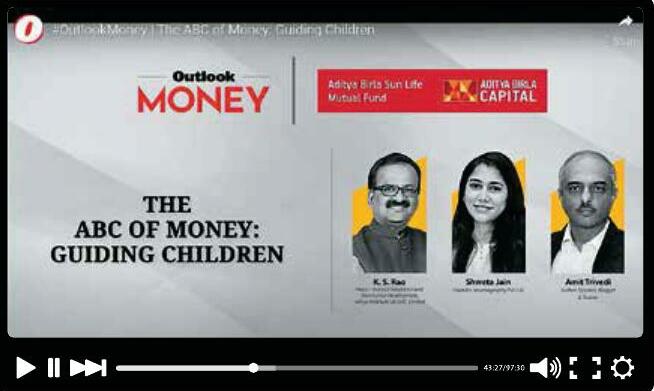

Planning for children’s future is one of the most important goals for most parents. But what is equally important is inculcating the right financial and savings habit among children so that they can build a secure future for themselves when they are ready for it. A recent panel discussion, organized by Aditya Birla Sun Life Mutual Fund in association with Outlook Money, discussed this important aspect. The topic of the discussion ‘The ABC of Money: Guiding Children’. The panelists were K.S. Rao, head of investor education and distribution development at Aditya Birla Sunlife AMC; Amit Trivedi, an author, speaker, blogger, and trainer; and Shweta Jain, a certified financial planner and founder of Investography Pvt. Ltd. The panel was moderated by Nidhi Sinha, Editor, Outlook Money.

START EARLY

Rao said that it is important to teach financial literacy at the school level but since that is not a reality, parents need to take up this challenge themselves. “Parents are the best teachers when it comes to values, whether it is about teaching the value of money or other values. to teach anything, and not only the value of money, but even moral and social values. They can lay the foundation for children.”

Esta historia es de la edición December 2023 de Outlook Money.

Suscríbete a Magzter GOLD para acceder a miles de historias premium seleccionadas y a más de 9000 revistas y periódicos.

¿Ya eres suscriptor? Iniciar sesión

MÁS HISTORIAS DE Outlook Money

Outlook Money

Don't Step Into The Equity SIP Illusion

SIPS are a powerful tool for wealth creation, but only if you do not give in to illusions such as SIPS always give double-digit returns

8 mins

January 2026

Outlook Money

The "Choose Your Fighter" Fund for a Rotating Market

They shift between large mid and small caps as valuations, cycle signals and risk change.

2 mins

January 2026

Outlook Money

IPO RUSH HOW TO STEER YOUR IPO JOURNEY

IPO boom is back with a bang. Amid the listing-day frenzy, the real question is whether investors are chasing momentum or backing fundamentals. We bust myths to give you real strategies

8 mins

January 2026

Outlook Money

Democratising Debt Investing

Online bond platform providers, which operate under Sebi regulations, have democratised retail access to bonds, but retail investors should understand the risks involved before buying

3 mins

January 2026

Outlook Money

Beyond Equity, Dynamic Asset Allocation is key to Emerging India

\"Long-term wealth preservation may be achieved not just by trying to earn the highest possible returns, but also by managing risk effectively.\"

2 mins

January 2026

Outlook Money

Why Traditional Portfolios Failed The 2025 Test?

2025 exposed a fragmented market where static diversification diluted gains and missed leadership shifts.

2 mins

January 2026

Outlook Money

Small Habits To Success

Good habits build you up, while bad habits pull you down. The one thing to ensure is that your habits are putting you on the path towards success. So, focus on your current trajectory

4 mins

January 2026

Outlook Money

Here's How To Add Or Change A Bank Nominee

From November 1, banks have allowed customers to name up to four nominees for accounts, deposits and lockers. Change or cancellation of a nominee must be acknowledged by the bank within three working days. Nominee details appear on passbooks, statements, and fixed deposit receipts.

1 min

January 2026

Outlook Money

An IPO To Fund Growth Without Distraction

Keertana is choosing public capital early to scale profitably and reduce dependence on repeated private rounds

2 mins

January 2026

Outlook Money

Riding On Expansion In South

India Shelter Finance Corporation is one of the fastest-growing affordable housing finance companies (HFCs) in India, catering to home buyers in tier II and III cities and towns. It operates across 15 states and Union Territories (UTs) with major presence in Rajasthan, Maharashtra and Madhya Pradesh.

2 mins

January 2026

Translate

Change font size