Essayer OR - Gratuit

How Liquidity In ETF Is Different From Liquidity In Stocks

Dalal Street Investment Journal

|November 25 - December 8, 2019

The equity markets saw a good recovery in the month of October and early November.

-

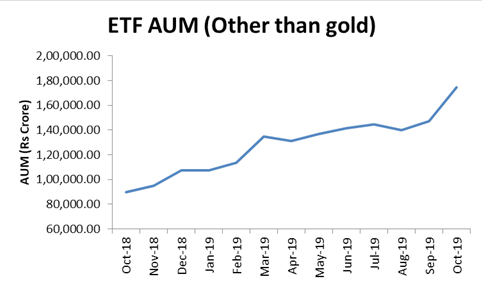

However, many investors booked profits on their investments,thereby resulting in a decline in net inflows in equity dedicated mutual funds. For the month of October 2019, equity dedicated mutual funds saw a net inflow of ₹6,026 crore, which is a decline of 9 per cent sequentially and is also a five month low net inflow figure. Against this backdrop, Exchange Traded Funds (ETFs) saw a significant jump in inflows for the same period. From ₹1,521 crore of inflows in the month of September, the inflows in ETFs jumped fourfold to ₹6,682 crore in the month of October. One of the reasons for such increase is funds was deployment from Employees’ Provident Fund Organisation (EPFO) into appointed fund houses. At present, the EPFO is only allowed to make equity investments through passively-managed ETFs.

Apart from EPFOs, passive investment has been and is being popularly followed by various investor profiles. Investing in an index ETF, whose portfolio plainly mimics the composition of an index, is an example of passive investment as the investment does not call for any research and analysis to pick stocks. Like in the case of various developed markets, India may follow the popularity of passive investments; however, there are some misconception and lack of understanding about an ETF (a popular and common vehicle of passive investing), which is deterring some investors, especially retail investors. The point of confusion is many investors believe that since individual stocks and ETFs have many similarities, they might be sharing similar liquidity traits. Therefore, liquidity of the ETF is determined in a similar manner as liquidity of stocks. Nonetheless, ETFs are fundamentally different from stocks and have robust liquidity characteristics, which is frequently misunderstood.

Liquidity in ETF

Cette histoire est tirée de l'édition November 25 - December 8, 2019 de Dalal Street Investment Journal.

Abonnez-vous à Magzter GOLD pour accéder à des milliers d'histoires premium sélectionnées et à plus de 9 000 magazines et journaux.

Déjà abonné ? Se connecter

PLUS D'HISTOIRES DE Dalal Street Investment Journal

Dalal Street Investment Journal

Capital Markets 2.0: From a Banyan Tree to Billion-Dollar Trades

From open street gatherings to today's tech-driven markets handling crores in daily turnover, India's capital markets have truly come a long way. But the transformation isn't over yet. In this story, Mandar Wagh explores the next wave of evolution reshaping India's financial landscape, highlighting SEBI's progressive reforms, the rise of a strong digital backbone, and the key companies positioned to benefit from this structural shift

6 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

India Inc's Q1 FY26: A Tale of Resilience and Reckoning

Q1FY26 has revealed a corporate India that's adapting smartly to shifting global currents while drawing strength from domestic policy support. With RBI's timely rate cuts cushioning demand, sectors like banking and insurance have surged ahead, even as IT and consumer segments navigate headwinds. Early results from 200+ companies suggest a story of selective strength and strategic resilience. The rest of the earnings season could either cement this momentum—or test it

5 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

RIDING WATER INFRA BOOM WITH VALUE-ADDED GROWTH

Jai Balaji Industries Ltd

2 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

Active Momentum Funds Timing the Market or Tapping the Trend?

Abhishek Wani evaluates whether India's active momentum funds are skillfully timing markets or simply riding trends. By dissecting strategies of Samco and Quant, he scrutinizes the fine line between tactical rotation and disciplined trend-following in a volatile momentum investing landscape

10 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

FIEM INDUSTRIES LTD LEADING THE CHARGE IN AUTOMOTIVE LED LIGHTING

India has become the fastestgrowing major economy in the world in recent years, which has led to significant demand for automobiles, including auto components.

2 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

The Case for Value-Oriented Mutual Funds

We Indians love a good bargain. Known for our haggling skills, we take pride in not overpaying - whether it's for a product or a service. After all, why pay more than what something is truly worth?

2 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

EMI vs SIP : Finding the Financial Sweet Spot

With rising home loan interest rates and evolving tax rules, many individuals face a critical choice- should surplus funds go toward prepaying their loan or building long-term wealth through SIPs? This piece compares both strategies across scenarios, helping you make an informed decision based on savings, returns, risk, and time horizon

9 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

Make Your Portfolio Inflation-proof

Inflation is crucial to investing as it reduces the value of your money over time. Therefore, keeping up with the rate of inflation, to protect the value of investments, should be the top priority for every long-term investor. Remember, the ability to earn a positive real rate of return, i.e., gross returns minus taxes minus inflation, would depend upon the composition of the portfolio.

2 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

AI Tailwind in IT Stocks: Time to Reboot Your Tech Portfolio?

After one year of sectoral underperformance, Indian IT is quietly undergoing its most radical overhaul since the cloud revolution, this time led by AI. The shift isn't cosmetic; it's existential. GenAI is reshaping services, rewarding agile midcaps and prompting investors to rethink legacy bets. The future of tech belongs to the AI-ready.

11 mins

July 28 - August 10, 2025

Dalal Street Investment Journal

Gen Z: High Conviction Story, but Priced to Perfection?

From skincare routines to fashion trends, Gen Z is transforming how India consumes. This digital-first generation doesn't just buy; they curate experiences, demand personalization, and look for authenticity in every swipe and scroll. As India's 440-million-strong Gen Z cohort begins to dominate discretionary spending, platforms built to speak their language stand to gain immensely. Nykaa, India's leading content-led, lifestyle retail platform, is at the forefront of this generational shift

8 mins

July 28 - August 10, 2025

Translate

Change font size