CATEGORIES

Kategorier

THE BOOK OF RUTH

How an American radical reinvented back-yard gardening.

LEAVE WITH DESSERT

Graydon Carter’s great magazine age.

JUST BETWEEN US

The pleasures and pitfalls of gossip.

THE FRENZY Joyce Carol Oates

Early afternoon, driving south on the Garden State Parkway with the girl beside him.

Naomi Fry on Jay McInerney's "Chloe's Scene"

As a teen-ager, long before I lived in New York, I felt the city urging me toward it. N.Y.C., with its art and money, its drugs and fashion, its misery and elation—how tough, how grimy, how scary, how glamorous! For me, one of its most potent siren calls was “Chloe’s Scene,” a piece written for this magazine, in 1994, by the novelist Jay McInerney, about the then nineteen-year-old sometime actress, sometime model, and all-around It Girl Chloë Sevigny.

INTERIORS

The tyranny of taste in Vincenzo Latronico’s “Perfection.”

ONWARD AND UPWARD WITH THE ARTS BETTING ON THE FUTURE

Lucy Dacus after boygenius.

INHERIT THE PLAY

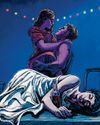

The return of “A Streetcar Named Desire” and “Ghosts.”

YOU MAD, BRO?

Young men have gone MAGA. Can the left win them back?

UPDATED KENNEDY CENTER 2025 SCHEDULE

April 1—A. R. Gurney’s “Love Letters,” with Lauren Boebert and Kid Rock

STEAL, ADAPT, BORROW

Jonathan Anderson transformed Loewe by radically reinterpreting classic garments. Is Dior next?

MacBook Air

THE POWER OF THE M4 CHIP MEETS ULTRA-PORTABILITY

IROBOT LAUNCHES EIGHT NEW ROOMBAS WITH LIDAR MAPPING

This week, iRobot unveiled its most ambitious lineup yet, introducing eight new Roomba models that bring lidar mapping to the brand for the first time.

3D PRINTING SPEEDS WILDFIRE RECOVERY: HOMES FROM THE ASHES

Azure Printed Homes is turning tragedy into triumph, using 3D printing to rebuild LA homes lost to wildfires. This tech slashes recovery time from years to days, offering displaced tech users a fast, affordable lifeline. It's not a gimmick—it's a roof over your head, built smarter.

APPLE VISION PRO ROCKS WITH METALLICA: AN IMMERSIVE CONCERT EXPERIENCE UNLEASHED

Apple has rolled out a groundbreaking addition to its Vision Pro lineup, unveiling an immersive concert experience featuring Metallica that promises to redefine how fans experience live music.

META'S NEW PLAY: CROWD-SOURCED FACT-CHECKING COMES TO FACEBOOK AND INSTAGRAM

Meta Platforms Inc., the powerhouse behind Facebook and Instagram, is set to launch a bold experiment in battling misinformation with its crowd-sourced fact-checking program, Community Notes, starting March 18, 2025.

FSR 4 SET TO ELEVATE PS5 PRO GRAPHICS IN 2026: A CLEARER PICTURE AHEAD

PlayStation's lead architect Mark Cerny dropped a tantalizing hint about the PS5 Pro's future, revealing that AMD's new FSR 4 upscaling technology will shape the \"next evolution\" of the console's PlayStation Spectral Super Resolution (PSSR).

STARSHIP FLIGHT 8: A STEP FORWARD, A STUMBLE UPWARD, AND THE ROAD TO REUSABILITY

SpaceX's eighth Starship flight test, dubbed Flight 8, soared into the skies above South Texas, delivering a mix of triumph and turbulence that underscores the company's relentless push toward a reusable future.

GROK AND XAI'S AI INFRASTRUCTURE: ELON MUSK'S SUPERCHARGED BRAIN TRUST

Elon Musk's xAl is making waves this week with Grok, a super-smart AI powered by a massive computer setup that's hard to wrap your head around.

IOS 19 RUMORED TO BE ONE OF APPLE'S BIGGEST IPHONE UPDATES EVER

This week, whispers about iOS 19 are stirring excitement among iPhone users, with Bloomberg reporting it could be one of the most transformative updates in Apple's history.

AI-POWERED FARMING TOOLS GAIN TRACTION: FEEDING THE FUTURE

California's Farm-ng is sowing a quiet revolution, using AI and robotics to transform farming. Announced this week, via CBS News, these tools tackle seeding and harvesting with precision, promising US tech users fresher food and lower prices. It's not futuristic hype-it's tech that's already working the fields.

WAYMO'S CHINESE-MADE EVS CLEARED FOR US DELIVERY: A ROBOTAXI REVOLUTION BEGINS

Waymo's latest move is a game-changer: Chinese-made Zeekr electric vehicles (EVs) are set to hit US streets by late 2025, dodging tariffs and bringing autonomous rides closer to reality.

WASTING TOO MUCH TIME ON SOCIAL MEDIA APPS? TIPS AND TRICKS TO CURB SMARTPHONE USE

Smartphones have woven themselves into daily life, offering instant connection and endless scrolls through apps like X, Instagram, and TikTok.

SPORTS STREAMING SCORES BIG: APPLE TV+ AND MORE BRING THE GAME HOME

Sports are roaring back to television screens, and streaming services are leading the charge, blending live action with on-demand convenience. Platforms like Apple TV+, Paramount+, ESPN+, Hulu, and Peacock have tapped into the fervor, delivering key moments from ice rinks to gridirons.

TIKTOK DEAL IS IN THE WORKS: HERE'S WHERE THINGS STAND WITH THE COMPANY

TikTok's future in the United States hangs in a delicate balance as negotiations swirl around a potential sale of its operations, a saga blending tech innovation, geopolitical tension, and corporate ambition.

GEMINI GETS PERSONAL: TAILORED HELP FROM YOUR GOOGLE APPS

Google’s AI assistant, Gemini, is stepping up its game with a fresh twist—personalization that taps into your everyday digital life.

Make Democrats Funny Again

The party has defined itself entirely in opposition to Donald Trump and forgotten that people vote for the person they'd rather grab a beer with

Windward Roads Infrastructure: Paving Sint Maarten's Future with Innovation & Resilience

Building Resilience and Innovation in Caribbean Infrastructure

A Mammoth Breakthrough

A biotech team has created a “woolly mouse,” marking a step forward in the quest to revive the long-extinct species

How Trump's cuts are hurting his voters

CLARKSBURG, W.VA., HAS LEAD PIPES SCATTERED THROUGH- out the city, which has caused elevated levels of lead in some children’s blood, resulting in health issues like developmental delays.