Prøve GULL - Gratis

SANITY OF SAFETY OR RUSH OF RISK

Outlook Money

|August 2020

You are utterly confused. Between April and June this year, many hurriedly scurried out of equities. And the stock indices bounced back with a vengeance in July. Now, there is frustration and desperation about the lost opportunities, as people wait for stock prices to correct so that they can re-enter. To seek safe havens, some of us got into cash, debt, and gold. Sadly, in these cases too, the events unexpectedly turned against us. The situation baffled us. Armed with cash, the hapless investors decided to ‘time the market’, and act on their own – largely as day traders. They realised, like many did in the past, that it is almost impossible to do so. Even the experts are unable to predict the random walks of the stock market. While debt seemed secure, there was uncertainty about future returns as interest rates fell, and inflation inched up. Gold seemed a no-brainer but was this a good time to buy at such high prices? Most investors are shocked and stunned. To be safe or take risks, that is the question today. What should one do over the next 3-6 months? Is it better to take the plunge into equities, and ride out the topsy-turvy waves and volatility in the market? Is it more pertinent to accept lower returns, but protect our investments, and shift to debt? Is bullion the new calling for most of us? As some experts contend, if there’s one advice they wish to give, it is to be in gold. In this cover story, Outlook Money takes a 360-degree look at short-term strategies to shield your wealth from tumultuous upheavals, and simultaneously safeguard your returns. We present the pros and cons related to each asset category to enable you to make informed and insightful decisions. Beware that there is no one shoe-size that will fit every feet. At the end of the day, we are on our own, and we will need to carefully re-construct our plans on an individual basis.

We consider ourselves to be rational human beings. But even the smartest of us tend to panic. Worse, we later defend our dim-witted decisions as logical and sensible. Given the information we had at that time, we theorise, what we did was the best we could. There were few choices, and we had to act in real time. Any delays from our side could only worsen the situation. Moreover, we couldn’t sit back, and watch our wealth being eroded, minute-by-minute, day-by-day.

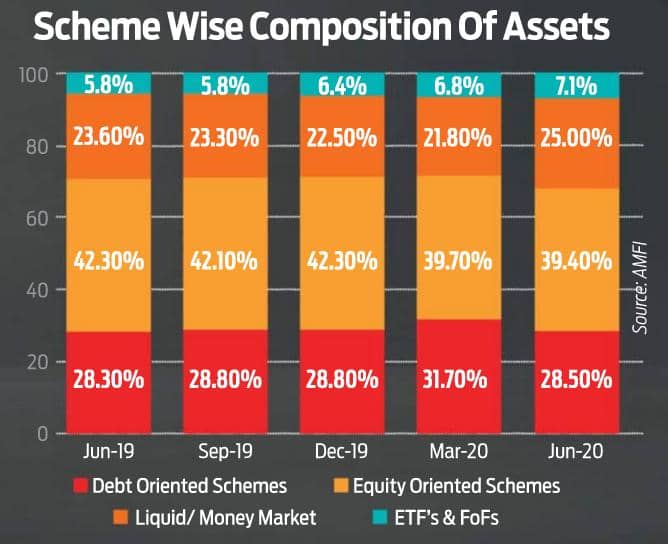

Nothing epitomised this panicked-rationality better than the mayhem in the mutual funds market. As the Indian stock indices tumbled by almost 40 per cent by March 23 this year, the crazed investors ran away in herds. In June, they pulled out a massive ₹13,500 crore from the equity-oriented schemes, an increase of more than 75 per cent compared to the previous month. The overall monthly inflows in such funds in June were the lowest in the past four years.

Massive outgoes were witnessed in the multicap equity funds, followed by the large-cap ones. A similar trend gripped the hybrid funds, which invest in a mix of equity and debt; arbitrage funds proved to be an exception. The mid-cap category survived the bedlam, but monthly inflows fell to ₹36.70 crore in June. Ironically, as the markets recovered, the assets-under-management of the equity funds grew by 8 per cent between May and June this year.

Denne historien er fra August 2020-utgaven av Outlook Money.

Abonner på Magzter GOLD for å få tilgang til tusenvis av kuraterte premiumhistorier og over 9000 magasiner og aviser.

Allerede abonnent? Logg på

FLERE HISTORIER FRA Outlook Money

Outlook Money

Beyond Equity, Dynamic Asset Allocation is key to Emerging India

\"Long-term wealth preservation may be achieved not just by trying to earn the highest possible returns, but also by managing risk effectively.\"

2 mins

January 2026

Outlook Money

Don't Step Into The Equity SIP Illusion

SIPS are a powerful tool for wealth creation, but only if you do not give in to illusions such as SIPS always give double-digit returns

8 mins

January 2026

Outlook Money

Small Habits To Success

Good habits build you up, while bad habits pull you down. The one thing to ensure is that your habits are putting you on the path towards success. So, focus on your current trajectory

4 mins

January 2026

Outlook Money

Here's How To Add Or Change A Bank Nominee

From November 1, banks have allowed customers to name up to four nominees for accounts, deposits and lockers. Change or cancellation of a nominee must be acknowledged by the bank within three working days. Nominee details appear on passbooks, statements, and fixed deposit receipts.

1 min

January 2026

Outlook Money

An IPO To Fund Growth Without Distraction

Keertana is choosing public capital early to scale profitably and reduce dependence on repeated private rounds

2 mins

January 2026

Outlook Money

The "Choose Your Fighter" Fund for a Rotating Market

They shift between large mid and small caps as valuations, cycle signals and risk change.

2 mins

January 2026

Outlook Money

Riding On Expansion In South

India Shelter Finance Corporation is one of the fastest-growing affordable housing finance companies (HFCs) in India, catering to home buyers in tier II and III cities and towns. It operates across 15 states and Union Territories (UTs) with major presence in Rajasthan, Maharashtra and Madhya Pradesh.

2 mins

January 2026

Outlook Money

Rotate Sectors With The Cycle Not The Noise

Track signals to spot recovery or slump then shift sector exposure before consensus catches up.

2 mins

January 2026

Outlook Money

Banking On Loan Growth

ICICI Bank is among India's most structurally strong private banks, backed by consistent financial performance, superior risk management, and a well-diversified business franchise.

1 mins

January 2026

Outlook Money

Higher Margins Bode Well

Max Financial Services owns 80 per cent of Max Life, which is one of India’s largest private life insurers.

1 mins

January 2026

Translate

Change font size