Denemek ALTIN - Özgür

A Focus On Grievance And Complaint

Outlook Money

|September 2020

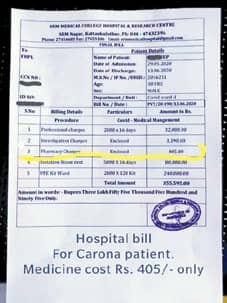

Health insurance policyholders are caught between hard rock and deep-sea as they struggle to settle their claims

Holders of health insurance policies encounter multiple challenges when it comes to renewing old policies or getting their claims settled by insurance companies.

According to them, the insurers are busy patting their backs by claiming that they receive very few complaints from policyholders, hence suggesting that customers are largely satisfied with their services.

The government has appointed several Insurance Ombudsman across the country to handle grievances of insurance customers. Even though the move has brought the redressal framework into focus, it works through a system that appears to be quite discouraging.

Policyholders of Health Insurance (HI) are compelled to run from pillar to post to either get their policy renewed or even their claims settled.

Normally, they directly approach the ombudsman with their grievances. However, insurers often deny the renewal of HI policy on the ground of Pre-Existing Disease (PED). Their woes do not stop here, as it is found that the policyholders’ claims get deferred for an uncertain period on some flimsy ground.

Jagriti Chandra, a New Delhi based professional, had taken a health insurance policy from Oriental Insurance along with a top-up of ₹20 lakh from Liberty two years back.

“It has been two months that I despatched the claim form along with all the required originals and have not received an acknowledgment yet,” claims Chandra.

Now the question arises which insurer state-run or private sector one is better in terms of premium rates or hassle-free claim settlement.

Bu hikaye Outlook Money dergisinin September 2020 baskısından alınmıştır.

Binlerce özenle seçilmiş premium hikayeye ve 9.000'den fazla dergi ve gazeteye erişmek için Magzter GOLD'a abone olun.

Zaten abone misiniz? Oturum aç

Outlook Money'den DAHA FAZLA HİKAYE

Outlook Money

Don't Step Into The Equity SIP Illusion

SIPS are a powerful tool for wealth creation, but only if you do not give in to illusions such as SIPS always give double-digit returns

8 mins

January 2026

Outlook Money

The "Choose Your Fighter" Fund for a Rotating Market

They shift between large mid and small caps as valuations, cycle signals and risk change.

2 mins

January 2026

Outlook Money

IPO RUSH HOW TO STEER YOUR IPO JOURNEY

IPO boom is back with a bang. Amid the listing-day frenzy, the real question is whether investors are chasing momentum or backing fundamentals. We bust myths to give you real strategies

8 mins

January 2026

Outlook Money

Democratising Debt Investing

Online bond platform providers, which operate under Sebi regulations, have democratised retail access to bonds, but retail investors should understand the risks involved before buying

3 mins

January 2026

Outlook Money

Beyond Equity, Dynamic Asset Allocation is key to Emerging India

\"Long-term wealth preservation may be achieved not just by trying to earn the highest possible returns, but also by managing risk effectively.\"

2 mins

January 2026

Outlook Money

Why Traditional Portfolios Failed The 2025 Test?

2025 exposed a fragmented market where static diversification diluted gains and missed leadership shifts.

2 mins

January 2026

Outlook Money

Small Habits To Success

Good habits build you up, while bad habits pull you down. The one thing to ensure is that your habits are putting you on the path towards success. So, focus on your current trajectory

4 mins

January 2026

Outlook Money

Here's How To Add Or Change A Bank Nominee

From November 1, banks have allowed customers to name up to four nominees for accounts, deposits and lockers. Change or cancellation of a nominee must be acknowledged by the bank within three working days. Nominee details appear on passbooks, statements, and fixed deposit receipts.

1 min

January 2026

Outlook Money

An IPO To Fund Growth Without Distraction

Keertana is choosing public capital early to scale profitably and reduce dependence on repeated private rounds

2 mins

January 2026

Outlook Money

Riding On Expansion In South

India Shelter Finance Corporation is one of the fastest-growing affordable housing finance companies (HFCs) in India, catering to home buyers in tier II and III cities and towns. It operates across 15 states and Union Territories (UTs) with major presence in Rajasthan, Maharashtra and Madhya Pradesh.

2 mins

January 2026

Translate

Change font size