Versuchen GOLD - Frei

Investing in China: the how and why of it

Mint Mumbai

|March 17, 2025

Even as Indian stock markets go through a rough patch, Chinese equities have rebounded after lagging for around a decade.

Global investors are looking to ride this rally. Over the past 10 years, the Shanghai SE Composite Index rose just 2.5%. However, the Chinese government's stimulus measures to boost domestic consumption and DeepSeek's AI model lifted the sentiment. China's benchmark index has delivered 12.55% returns over the past one year compared with a 1.8% rise in the Nifty 50 during the period in terms of local currency.

Trading volumes of iShares China Large-Cap ETF, which tracks Chinese blue-chip stocks, swelled 2.8 times in February, according to data from global investing platform Vested Finance.

In this series on global investing, we explore how Indians can invest in different geographies. Here is a look at the investment routes available for local investors looking to participate in the Chinese markets.

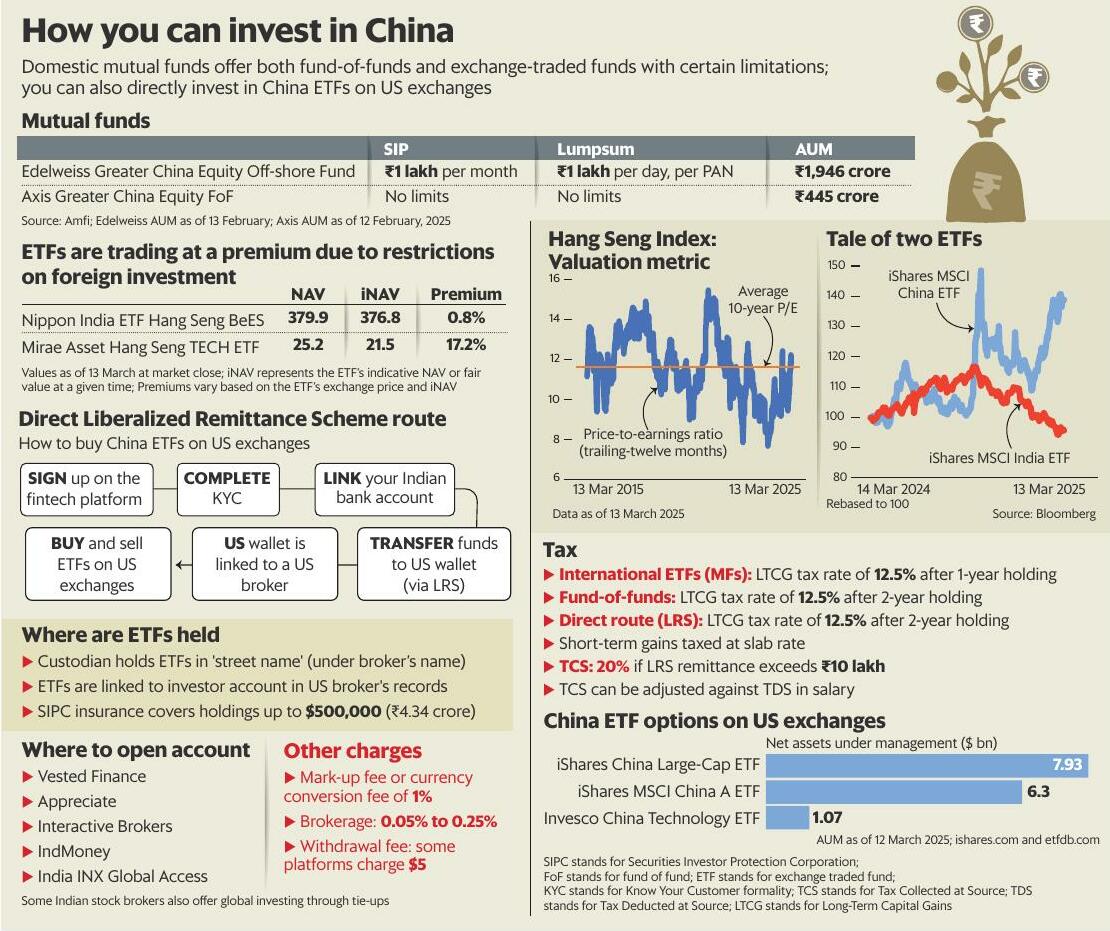

Mutual funds

Mutual funds Edelweiss Greater China Equity Off-shore Fund and Axis Greater China Equity FoF are two funds of funds open for Indian investors. For Edelweiss's fund, the lumpsum investment limit is 1 lakh a day, per PAN (permanent account number) and that also applies to monthly systematic investment plans (SIPs). The fund had ₹1,946 crore in assets under management (AUM) as on 13 February. The Axis Greater China Equity FoF is fully open without investment limits. Its AUM stood at ₹445 crore as of 12 February 2025.

As an FoF, Edelweiss fund feeds into JPMorgan Greater China Fund while the Axis fund feeds into the Schroder International Selection Fund Greater China. Capital gains from the funds will be taxed as long-term capital gains at 12.5% if the investment is held for more than two years, and if held for less, short-term gains are taxed at the income tax slab rate of an investor.

Diese Geschichte stammt aus der March 17, 2025-Ausgabe von Mint Mumbai.

Abonnieren Sie Magzter GOLD, um auf Tausende kuratierter Premium-Geschichten und über 9.000 Zeitschriften und Zeitungen zuzugreifen.

Sie sind bereits Abonnent? Anmelden

WEITERE GESCHICHTEN VON Mint Mumbai

Mint Mumbai

Job applicants are winning the Al arms race against recruiters

Many hundred recruiters would have greeted the release of ChatGPT with glee.

2 mins

January 17, 2026

Mint Mumbai

Sebi floats reforms to ease FPI fund settlement, KYC

Acting on market feedback, the Securities and Exchange Board of India (Sebi) released a consultation paper on Friday that proposes to allow foreign portfolio investors (FPIs) to net funds, a move aimed at easing settlement rules to lower funding costs and address operational inefficiencies.

3 mins

January 17, 2026

Mint Mumbai

Govt plans to reopen Tiger Global tax case, but treads with caution

Armed with a favourable Supreme Court decision, India’s tax authority plans to proceed with caution while reopening assessment against Tiger Global Management LLC's 2018 stake sale in Flipkart Pvt., respecting the company’s right to appeal, according to two officials familiar with the matter.

2 mins

January 17, 2026

Mint Mumbai

IT's Big Five face $500 mn labour code hit to profit

India's new labour codes eroded the profits of India's five largest information technology (IT) services companies in the December quarter as they recorded ₹4,645 crore ($500 million) in upfront costs as higher contributions to employees' retirement benefits.

2 mins

January 17, 2026

Mint Mumbai

Shark Tank alumni's fame doesn't guarantee success

When a startup walks into Shark Tank India, the cheque is often the smallest part of the prize.

4 mins

January 17, 2026

Mint Mumbai

Reliance’s oil & gas slump drags down Q3 earnings

Profit up just 2% in December quarter despite improved results of other verticals

3 mins

January 17, 2026

Mint Mumbai

24 hours at the Kochi-Muziris Biennale

What to see if you have just a day, or even a few hours, at the ongoing Kochi Biennale, which is on at 22 venues

4 mins

January 17, 2026

Mint Mumbai

The uncommon self-confidence of Annie Besant

Despite the criticism heaped on her, Besant learned to be ruthless in putting her interest first, refusing to be led by men

6 mins

January 17, 2026

Mint Mumbai

Will Manish Mehrotra bring Delhi's crown back?

The chef opens Nisaba in the Humayun’s Tomb Museum Complex this weekend, signalling the Capital's place as a dining destination

4 mins

January 17, 2026

Mint Mumbai

The language of flower emojis

Physical flowers are a too-grand gesture IRL, but flower emojis have taken over texts as hearts seem too demonstrative

4 mins

January 17, 2026

Listen

Translate

Change font size