Essayer OR - Gratuit

Investing in China: the how and why of it

Mint Mumbai

|March 17, 2025

Even as Indian stock markets go through a rough patch, Chinese equities have rebounded after lagging for around a decade.

Global investors are looking to ride this rally. Over the past 10 years, the Shanghai SE Composite Index rose just 2.5%. However, the Chinese government's stimulus measures to boost domestic consumption and DeepSeek's AI model lifted the sentiment. China's benchmark index has delivered 12.55% returns over the past one year compared with a 1.8% rise in the Nifty 50 during the period in terms of local currency.

Trading volumes of iShares China Large-Cap ETF, which tracks Chinese blue-chip stocks, swelled 2.8 times in February, according to data from global investing platform Vested Finance.

In this series on global investing, we explore how Indians can invest in different geographies. Here is a look at the investment routes available for local investors looking to participate in the Chinese markets.

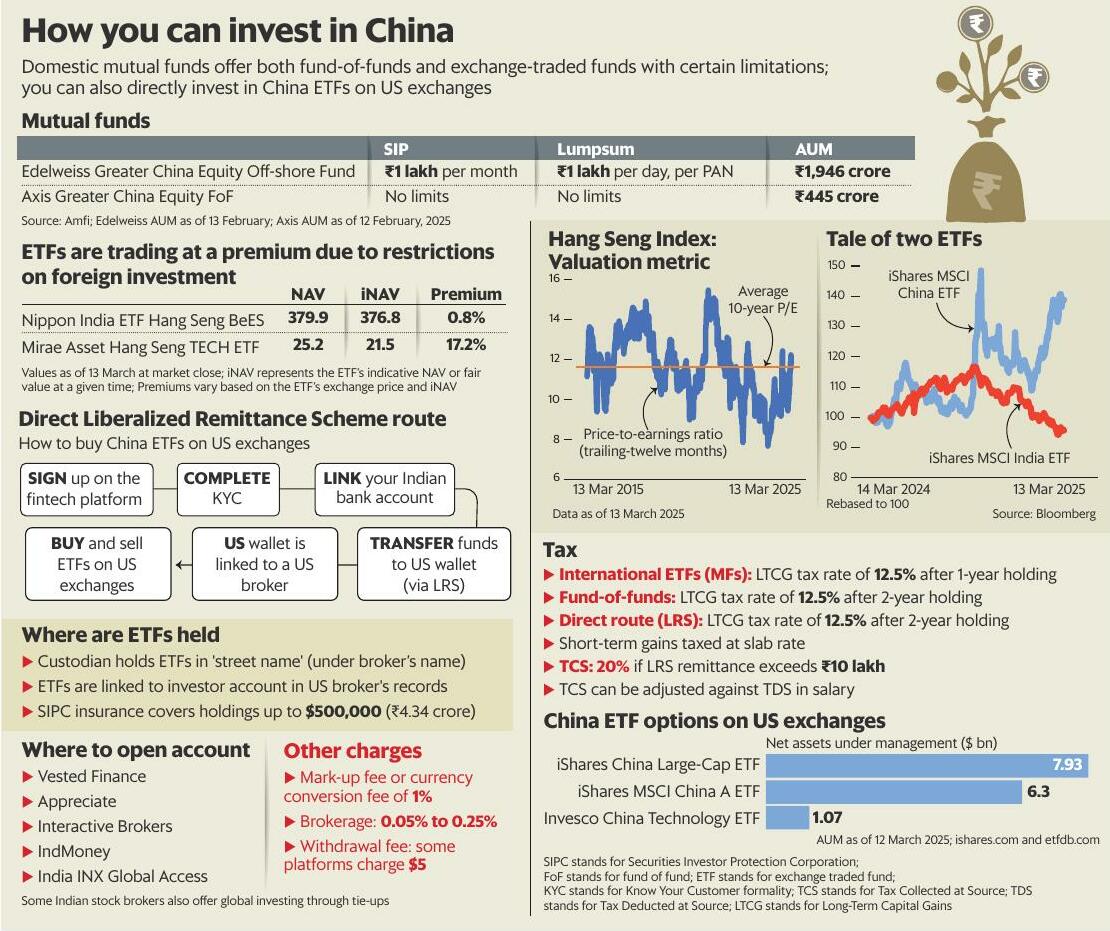

Mutual funds

Mutual funds Edelweiss Greater China Equity Off-shore Fund and Axis Greater China Equity FoF are two funds of funds open for Indian investors. For Edelweiss's fund, the lumpsum investment limit is 1 lakh a day, per PAN (permanent account number) and that also applies to monthly systematic investment plans (SIPs). The fund had ₹1,946 crore in assets under management (AUM) as on 13 February. The Axis Greater China Equity FoF is fully open without investment limits. Its AUM stood at ₹445 crore as of 12 February 2025.

As an FoF, Edelweiss fund feeds into JPMorgan Greater China Fund while the Axis fund feeds into the Schroder International Selection Fund Greater China. Capital gains from the funds will be taxed as long-term capital gains at 12.5% if the investment is held for more than two years, and if held for less, short-term gains are taxed at the income tax slab rate of an investor.

Cette histoire est tirée de l'édition March 17, 2025 de Mint Mumbai.

Abonnez-vous à Magzter GOLD pour accéder à des milliers d'histoires premium sélectionnées et à plus de 9 000 magazines et journaux.

Déjà abonné ? Se connecter

PLUS D'HISTOIRES DE Mint Mumbai

Mint Mumbai

Al is rewriting the script

In a surprisingly short period of time, Artificial Intelligence has ripped into every aspect of life, business, arts, leisure, society, entertainment.

1 mins

January 24, 2026

Mint Mumbai

Adani Group shares fall up to 15% after US SEC move

News of the US market regulator seeking to send summons in a bribery case directly to Adani Group promoter Gautam Adani and his nephew Sagar sent the group’s listed stocks tumbling between 3% and 15% on Friday.

2 mins

January 24, 2026

Mint Mumbai

The unseen hands behind India's rich botanical history

H.J. Noltie's new work sheds light on the lives of painters who were largely erased by their British colonial masters

4 mins

January 24, 2026

Mint Mumbai

A commitment to elevating patient care standards at CARE CIIGMA Hospitals

Founded in 2007 by Dr Unmesh Vidyadhar Takalkar, CIIGMA Hospital has emerged a revolutionary force in the healthcare landscape of Marathwada.

2 mins

January 24, 2026

Mint Mumbai

Vastu corrections without demolition

Internationally renowned Vastu expert Vimal Jhajharia and his son Vikas Jhajharia-an MBA from Australia-offer nondestructive Vastu corrections for toilets facing northeast, for homes that are south-facing, for the quick sale of land, various financial issues, health problems, matrimonial problems and so on.

1 min

January 24, 2026

Mint Mumbai

Budget may ease MSME debt woes

Proposal includes doubling repayment period before NPA label

3 mins

January 24, 2026

Mint Mumbai

FPI exits, earnings upset slam Street

Indian equities ended the week battered and bruised, as sustained foreign portfolio investor (FPI) outflows, weakening earnings momentum and pre-budget jitters combined to drag benchmark indices sharply lower.

2 mins

January 24, 2026

Mint Mumbai

WhiteSpace Consulting & Capability Building: Healthcare consulting that delivers

In healthcare and life sciences, ideas are abundant.

1 min

January 24, 2026

Mint Mumbai

‘Train Dreams’ and the magic of the ordinary

Clint Bentley's film, starring Joel Edgerton, is a mysterious and intimate frontier story

3 mins

January 24, 2026

Mint Mumbai

Trai starts review of DLC tariffs after 10 yrs

Banks, IT firms and data centres could see price changes for the private high-speed broadband lines they use to move data securely and run critical operations, as the telecom regulator has initiated its first review of domestic leased circuits (DLCs) prices in over a decade.

1 min

January 24, 2026

Listen

Translate

Change font size