Prøve GULL - Gratis

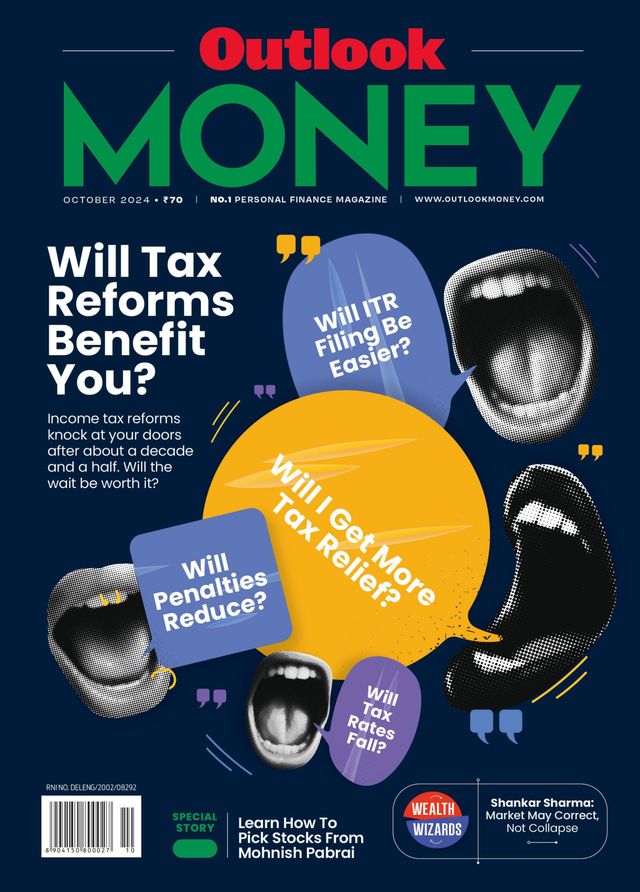

Outlook Money - October 2024

Gå ubegrenset med Magzter GOLD

Lese Outlook Money sammen med 9000+ andre magasiner og aviser med bare ett abonnement

Se katalogAbonner kun på Outlook Money

Avbryt når som helst.

(Ingen forpliktelser) ⓘHvis du ikke er fornøyd med abonnementet, kan du sende oss en e-post på help@magzter.com innen 7 dager etter abonnementets startdato for full refusjon. Ingen spørsmål - lover! (Merk: Gjelder ikke for enkeltutgavekjøp)

Digitalt abonnement

Øyeblikkelig tilgang ⓘAbonner nå for å begynne å lese umiddelbart på Magzter-nettstedet, iOS, Android og Amazon-appene.

I dette nummeret

Will Tax Reforms Benefit You?

MOHNISH PABRAI’S LESSONS IN THE DHANDHO OF INVESTING: Indian-American investor Mohnish Pabrai draws heavily from Warren Buffett’s investing philosophy, but he uses real-world scenarios, such as the Patel community’s business in the US to make his investment principles appeal to a wider audience. We get into the details of Pabrai’s investing philosophy to break it down for you.

‘MARKETS WILL MODERATE, NOT COLLAPSE SOON’: Shankar Sharma, founder of GQuant and First Global, shares with Nidhi Sinha, editor, Outlook Money, as part of the Wealth Wizards series, why being called the ‘Big Bear’ of Dalal Street is a cliché, that we are not going into a bear market anytime soon and what his investment mantra is.

Outlook Money Description:

Outlook Money is a monthly business magazine published by The Outlook Group in India. The magazine is known for its in-depth coverage of the Indian economy, as well as its insights from leading experts in the field. It covers a wide range of topics related to business, including:

* Economic news and analysis: Outlook Money covers the latest economic news and trends from India and around the world. The magazine also provides in-depth analysis of the Indian economy, as well as its impact on businesses and individuals.

* Industry news and trends: Outlook Money also covers the latest news and trends from different industries, such as technology, finance, healthcare, and manufacturing. This coverage helps readers to stay informed about the latest developments in their respective industries.

* Corporate news and profiles: Outlook Money also features corporate news and profiles of leading companies in India. These profiles provide readers with insights into the strategies and operations of these companies.

* Personal finance: Outlook Money also features articles on personal finance, such as investing, saving, and retirement planning. These articles help readers to make informed financial decisions.

Outlook Money is a valuable resource for anyone who is interested in business in India. It is a must-read for anyone who is looking to stay informed about the latest economic and business trends in the country, or who is looking for insights from leading experts in the field.

Nylige utgaver

February 2026

January 2026

December 2025

November 2025

October 2025

September 2025

August 2025

July 2025

June 2025

May 2025

April 2025

March 2025

February 2025

January 2025

December 2024

November 2024

September 2024

August 2024

July 2024

June 2024

May 2024

April 2024

March 2024

February 2024

January 2024

December 2023

November 2023

October 2023

September 2023

Relaterte titler

Business Today India

BW Businessworld

Indian Economy & Market

BANKING FINANCE

India Business Journal

Retailer

BUSINESS ECONOMICS

THE INSURANCE TIMES

Banking Frontiers

Consultants Review

Corporate Tycoons

SME Channels

Indian Transport & Logistics News

Smart Investment

Business Standard

Outlook Business

Financial Express Delhi

DataQuest

Siliconindia - India Edition

Mint Mumbai

Business Traveller India

Entrepreneur magazine

Auto Components India

CEO Insights

The Business Guardian

Cruising Heights

BioSpectrum Asia

Architect and Interiors India

The Machinist

Mint Bangalore